In a bold move amid escalating geopolitical tensions and Western sanctions, Russia’s Central Bank has supercharged its gold reserves, adding a staggering $112 billion in value since the end of 2024.

As of early December 2025, these holdings now stand at $310.7 billion—equivalent to roughly 2,330 tonnes of the precious metal, comprising over 42% of its total international assets!

Russia’s huge gold purchases mark an all-time high and position Russia as the world’s fifth-largest gold holder.

As of early December 2025, these holdings now stand at $310.7 billion—equivalent to roughly 2,330 tonnes of the precious metal, comprising over 42% of its total international assets!

Russia’s huge gold purchases mark an all-time high and position Russia as the world’s fifth-largest gold holder.

This isn’t just a defensive play; it’s a strategic pivot that’s sending shockwaves through global finance, challenging the supremacy of the US dollar and fueling a relentless climb in gold prices.

The Drivers Behind Russia’s Golden Fortress

Russia’s gold accumulation strategy kicked into overdrive following the 2022 invasion of Ukraine, when Western nations froze approximately $300 billion of its foreign reserves.

By freezing and confiscating Russia’s foreign reserves, Western gov’t essentially hamstrung their own efforts to control the global gold price- by driving Russia away from the US Dollar, and straight into the arms of GOLD.

Russia’s gold accumulation strategy kicked into overdrive following the 2022 invasion of Ukraine, when Western nations froze approximately $300 billion of its foreign reserves.

By freezing and confiscating Russia’s foreign reserves, Western gov’t essentially hamstrung their own efforts to control the global gold price- by driving Russia away from the US Dollar, and straight into the arms of GOLD.

In response to endless western sanctions, asset freezes, and outright confiscation, Moscow has aggressively diversified away from dollar-denominated assets, slashing US Treasury holdings from over $140 billion in 2012 to under $10 billion by 2022—a 93% drop.

Gold, with its timeless appeal as a hedge against inflation and currency volatility, became the cornerstone of this “de-dollarization” effort.

By late 2025, gold accounts for over 41% of Russia’s total international reserves, which hover around $720 billion (including frozen assets).

By late 2025, gold accounts for over 41% of Russia’s total international reserves, which hover around $720 billion (including frozen assets).

The Central Bank has ramped up domestic purchases, leveraging enhanced market liquidity and surging global prices to bolster its National Wealth Fund.

Even as some gold was sold in 2025 to fund budget deficits—dropping holdings from 405 tonnes to 232 tonnes in the fund—the overall reserve value exploded by 53.2% in dollar terms, outpacing the ruble’s 20.8% gain.

This dual-channel approach—official reserves paired with citizen buying (up 6% to 75.6 tonnes in 2024)—reflects a national obsession with the metal as a bulwark against economic isolation.

Implications for the US Dollar: A Slow Erosion of Hegemony

Russia’s gold spree is more than a survival tactic; it’s a direct assault on the dollar’s role as the world’s reserve currency. By pegging the ruble to gold at a fixed rate (5,000 rubles per ounce since 2022), Moscow is experimenting with a modern gold standard, aiming to make the ruble a viable alternative for trade settlements.

This aligns with broader BRICS efforts—led by Russia and China—to create gold-backed systems that bypass SWIFT and dollar-dominated infrastructure.

The impact? A subtle but accelerating de-dollarization. Russia’s shift has inspired emerging markets, where central banks now account for 25.9% of global gold demand.

Over 90% of Russia-China trade now occurs in rubles and yuan, sidelining the dollar.

If this trend spreads, it could erode the dollar’s pricing power, raise US borrowing costs, and expose American investors to portfolio losses in a weaker greenback environment.

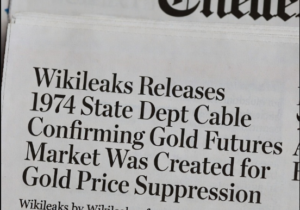

While the US (officially) holds the largest gold stash (over 8,100 tonnes), its steady holdings signal complacency, potentially leaving it vulnerable in a multipolar financial order. Worse yet, rumors persist throughout the market that the US gold reserves are LOOOONG GONE…leased out, & rehypothecated to manage gold prices over the past 50 years since Bretton Woods.

Gold Prices: From Hedge to Hot Commodity

No discussion of Russia’s buying binge is complete without addressing its turbocharge on gold prices. Spot gold shattered records 40 times in 2024 alone, surging 27% to above $4,000 per ounce by October 2025.

Central bank hoarding, amplified by Russia’s efforts, has doubled annual purchases to over 1,000 tonnes since 2022, driving demand to a record 4,900 tonnes last year.

This isn’t isolated—geopolitical jitters, low real interest rates, and inflation fears have all conspired to elevate gold’s safe-haven status.

Russia’s actions, by reducing supply availability and signaling institutional demand, have created a feedback loop: higher prices validate the strategy, encouraging more accumulation.

For investors, this means sustained upward pressure, though a stronger dollar could temper gains short-term.

For investors, this means sustained upward pressure, though a stronger dollar could temper gains short-term.

A New Financial Frontier

Russia’s $112 billion gold bonanza underscores a seismic shift: from dollar dependence to diversified resilience.

As Moscow’s vaults gleam brighter, the US dollar faces an existential nudge toward reinvention, while gold cements its resurgence as the ultimate geopolitical wildcard.

In this high-stakes game, the real winners may be those who bet on the yellow metal’s enduring allure.