After a short lived bounce from NVIDIA’s earnings report Wednesday, financial markets are hemorrhaging again today.

Bitcoin & Ethereum? Plunging.

Stocks? Red.

Treasuries? Bleeding.

Gold & silver? Down, but holding their own above support at $4,000 & $50.

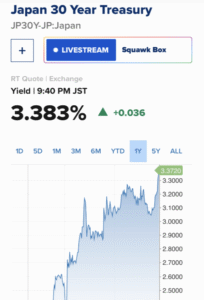

Japanese Government Bonds? Armageddon!

The financial “experts” are bewildered at the extent of such a violent sell-off, supposedly occurring on no “news”.

We suspect the Japanese Sovereign Debt Crisis IS the “news”:

Do all these “experts” have no understanding of the Yen Carry Trade & the FX Swap market?!

Japanese Government Bond yields are exploding to record high after record high- we could be witnessing the early stages of the complete unwinding of the carry trade.

Why do Japanese Gov’t Bonds matter?? Rising yields on Japanese Government Bonds puts pressure on the yen carry trade. The yen carry trade is only around $270 billion, right? Right?!

So what’s the big deal??

The big deal is the OTC swap market.

Off balance sheet transactions via the OTC FX swap market.

If you include the yen FX swap market transactions between yen and other currencies, the Yen OTC swap market currently sits ~ $14 TRILLION according to the BIS.

$14 TRILLION in FX swaps involving the yen essentially hedging FX moves between the yen & the dollar, yen & the euro etc that that could potentially undergo a forced unwind.

We suspect the purpose of a significant portion of those $14 TRILLION YEN FX swaps is to engage in a yen carry trade using FX swaps to borrow yen & then acquire that yen obligation by going through the FX swap.

If we are correct, the market is looking at a $14 TRILLION liquidity problem if the USD/ JPY continues to blow out, & the Japanese Gov’t Bond crisis escalates.

Thanks to OTC FX swaps, potentially $14 TRILLION in yen carry trade generated liquidity sloshing around US financial markets could be forced to reverse out of the markets.

We may be witnessing the very first stages of this unwind.

Buckle up ladies & gentlemen.

If we are correct, this ride is just getting started.