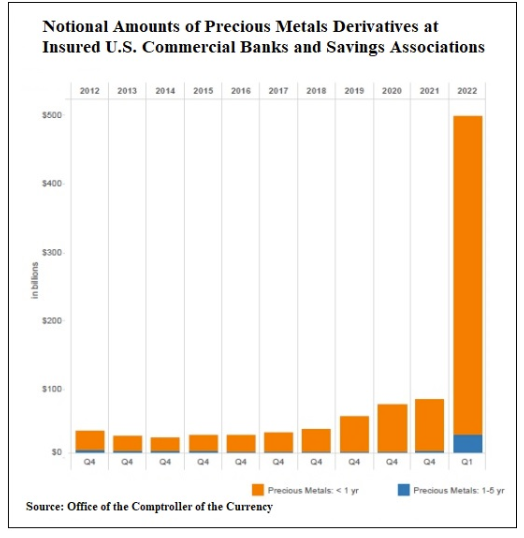

At the end of Q4 2021, Total Notional PM Derivatives at US Institutions Were Under $100 Billion.

February 23, 2022: Gold closes at $1,808/oz

February 24, 2022: Russia invades Ukraine, & the US & EU Immediately Freeze ~$250 Billion in Russian Central Bank Assets

By the end of Q1 2022, Total Notional PM Derivatives at US Financial Institutions Had Exploded to $500 BILLION! When the EU renewed Russian sanctions 6 months later & it became clear to the world that the EU had PERMANENTLY STOLEN $247B in Russia’s Central Bank reserves, Gold Prices Immediately Began a PARABOLIC ASCENT, which continues today.

When the EU renewed Russian sanctions 6 months later & it became clear to the world that the EU had PERMANENTLY STOLEN $247B in Russia’s Central Bank reserves, Gold Prices Immediately Began a PARABOLIC ASCENT, which continues today.  Clearly, in 2022 something BROKE in the cartel’s decades long control of the gold market.

Clearly, in 2022 something BROKE in the cartel’s decades long control of the gold market.

Even $500 BILLION in new synthetic precious metals derivatives were unable to maintain control of gold prices as gold burst through $2,000 an ounce for the first time.

$2,500 came shortly after, then $3,000, then $3,500, then $4,000 and beyond, with gold trading as high as $4,387/ troy oz.

The EU voted this week to INDEFINITELY freeze these Russian assets (to prevent Hungary & Slovakia from vetoing their use for Ukraine).

In response, gold broke out of an ascending triangle, and appears to be poised to break out to new all-time nominal highs, and resume its parabolic ascent.

They Forgot About Gold.

In their glee to confiscate Russia’s assets to harm Putin, the globalists forgot about gold.

They Shot Themselves in the Face When They Confiscated Russian Central Bank Reserve Assets!

Every other Central Bank on earth suddenly understood that their reserves could be confiscated and frozen upon a whim by the US or EU.

A Central Bank Gold Rush Was Unleashed on February 24, 2022, and it Now Threatens the NWO Globalists’ Very Empire.