For the first time ever, the 5 major US bullion banks have flipped NET LONG silver COMEX futures contracts!

From around 20,000 contracts net short, the US bullion banks have reduced their total silver short contracts to 17,838, vs 18,611 silver long contracts, a NET 773 contracts LONG!

As Ed Steer noted, the 17 non-US bullion banks now hold the entire NET short silver position, as they have INCREASED their net silver short 43,084 contracts – 215.42 MILLION oz!

The major US bullion banks flipping NET LONG on silver does not mean that they no longer hold any short silver positions, or that they cannot still short silver prices.

The US banks still hold 17,838 short positions in COMEX silver, and can add to these at any time. They are still able to spoof the market (not legally but they have been caught and charged previously for market spoofing) as well as add massive new short positions at any time to cause sudden vertical plunges in silver prices, and then subsequently close out those newly added short positions for big gains moments later.

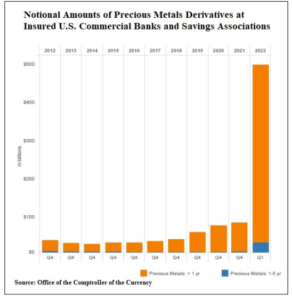

The Silver COT report also ONLY gives us a look at the bullion banks’ silver futures positions on the COMEX. We are unable to see the dark underbelly of the beast- their derivatives books.

The bullion banks derivatives books are off the exchange and even off the balance sheets- HUNDREDS OF TRILLIONS OF DOLLARS of OTC forwards, swaps, & leveraged directional bets on the gold and silver markets.

The bullion banks’ derivatives books have always been the REAL source of their gold & silver shorts- and that remains as opaque as ever.

Have the major 5 US bullion banks ALSO closed out their $TRILLIONS in silver short positions in the derivatives market because they know the final END GAME has arrived, and they are positioning themselves for the coming US dollar collapse?

OR have the US bullion banks closed out their short COMEX futures silver book simply to protect what is left of their physical silver inventory in COMEX vaults as COMEX longs continue to stand for delivery (December has already seen the highest amount of silver longs stand for delivery in the month of December EVER!)?

The price action in silver over the coming weeks and months may provide the answer to that question.

For now, this is a historic and unprecedented moment for the silver market, but investors should remain cautious.

The US bullion banks still may not be your friend (just yet).

US Banks Flip Net LONG Silver for 1st Time Ever!

X

Facebook

LinkedIn

Reddit

Print

Email