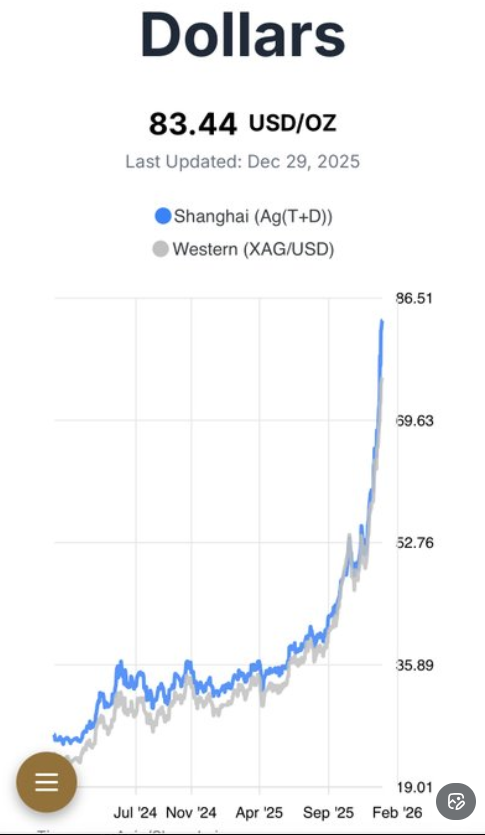

The silver market has experienced a historic 48 hours of trading since Friday morning.

As Western silver markets reopened Christmas night with the news that silver was trading near $80/oz in Shanghai, silver prices shot up over 11% Friday from $71.69 to close at $79.39.

Trading became even more disorderly over the weekend, as physical silver surged to $84.98 on the SHFE, with many reports that physical silver was selling over $90/oz across China.

Facing MASSIVE physical silver demand, US bullion retailers APMEX, SD Bullion, & JM Bullion were forced to raise their silver spot price – over the weekend- first $1.40 on Saturday night to $80.59, then another $1 late Sunday morning to $81.59.

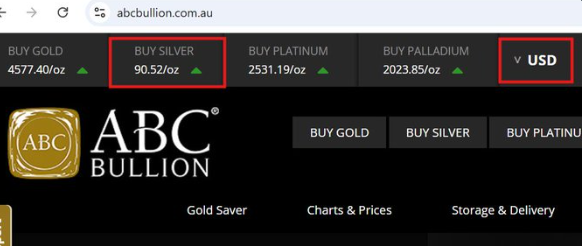

Australia’s largest bullion dealer ABC Bullion Raised its Silver Spot price Sunday afternoon to $90.52 USD/ $134.66 AUD!

When trading resumed at the 6pm EST Globex open, silver prices immediately moved VIOLENTLY to the upside, gapping up to a record $83.98.

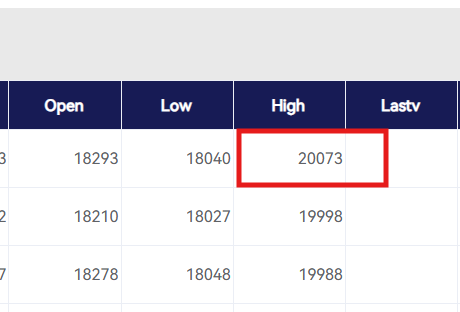

Silver’s move was even more explosive in Shanghai, as prices set a New RECORD HIGH of ¥20,073, eclipsing the Significant Psychological ¥20,000 Level on the SHFE- the equivalent of $89.05/oz!!

After spiking over 6% to $84/oz, the bullion banks arrived and dumped 50 MILLION oz of paper silver futures on the market in 15 minutes – nearly 7% of annual global silver supply.

Spot silver was smashed $8 from $84/oz to $76. Silver immediately received a bid and climbed $5 over the next few hours to nearly $81, when the 2nd wave of selling began.

Relentless paper selling forced silver prices all the way back to $70.54- a massive $13.44/oz from the overnight record high.

The COMEX futures sell-off widened the Shanghai silver spread to $12.17/oz, however, as Shanghai’s silver remains in the mid $80’s.

What comes next for silver? Did we just witness a parabolic blow-off long term top, that marked the END of the silver bull market, or is this a much needed cleansing to shake off the froth and the weak hands that chased silver prices higher?

Time will tell, but history tells us that massive technical chart formations- such as the 50 year cup and handle pattern – typically do not resolve/complete only 1 month after breaking out.

That does not mean that further downside is not possible in silver. Silver could certainly re-test its breakout near $55/oz, and remain in a long term secular bull market.

Silver chart technician Craig Hemke of TFMetalsReport.com is looking to buy the dip in silver at the 20-DMA, which is currently just below $65.

Hemke expects silver to likely bounce at the uptrend line however, just below $70/oz:

Many investors who missed silver’s move from $18 to $84 have been waiting for a pullback as an entry point- something which silver has REFUSED to provide investors over the past month since Thanksgiving night when this explosive rally kicked into high gear.

We now have a 16% pull back in silver prices, and many of those same investors now believe the silver bull market ended Sunday night.

We are not so sure.

If we are correct, and we are still in the early stages of a major secular bull move for silver, and this is just a much needed cleansing of the excess froth and euphoria that had built up in silver over the past week, it could be now or never for those who missed silver’s move to $85.

We are not licensed financial advisors, and this is not financial advice. Do your own due diligence, and trade with caution. Volatility is extreme in these markets, and we do not recommend readers trade on margin.

It Could Be NOW OR NEVER For Those Who Missed Silver’s Move to $85

X

Facebook

LinkedIn

Reddit

Print

Email