Gold and silver prices were in the process of breaking out this morning, with gold surging through resistance at the top of its triangle at $5,100 to $5,144, & silver surging to $86.31.

Chinese regulators on the SHFE cut silver hedging without quotas to ZERO in a desperate move to protect dwindling silver inventories, and to prevent another massive silver slam induced by speculative naked shorts.

https://x.com/silvertrade/status/2021589288258007194

Then the jobs number dropped.

+130,000 on expectations of +55,000. (With rumors of NEGATIVE numbers)

Gold & silver instantly puked.

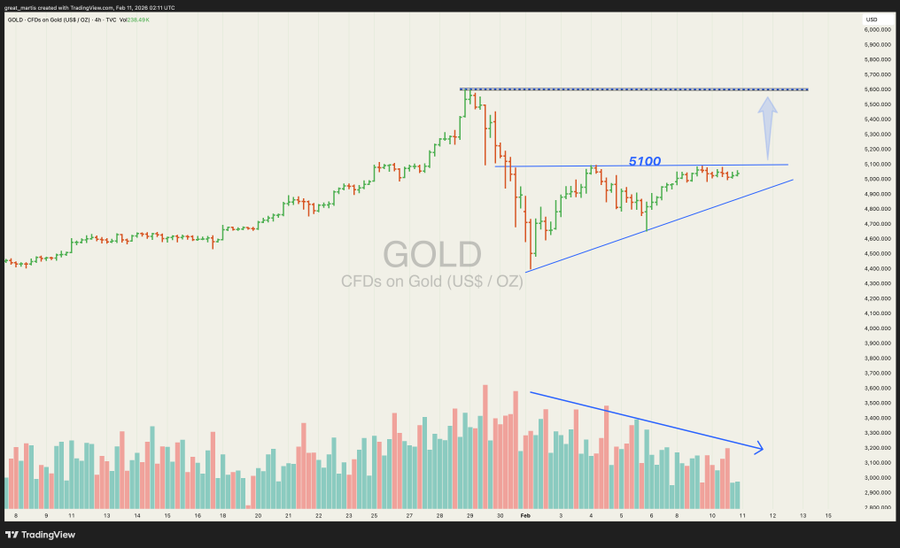

Gold instantly plunged back below $5,100.

Why is $5,100 so critical? As this chart from technical analyst The Great Martis ( @great_martis ) shows, a breakout about $5,100 essentially invalidates the thesis that gold (and by proxy silver) has topped in a blow off move to $5,600.

While gold & silver were smashed on HUGE jobs number headlines, the prior numbers were MASSIVELY REVISED DOWN by 1.029 million!

Today’s job numbers beating expectations means nothing when we all know the numbers will be revised lower by 150,000 in subsequent reports.

Large corporate bankruptcies just hit the highest level since COVID.

The US job market isn’t booming.

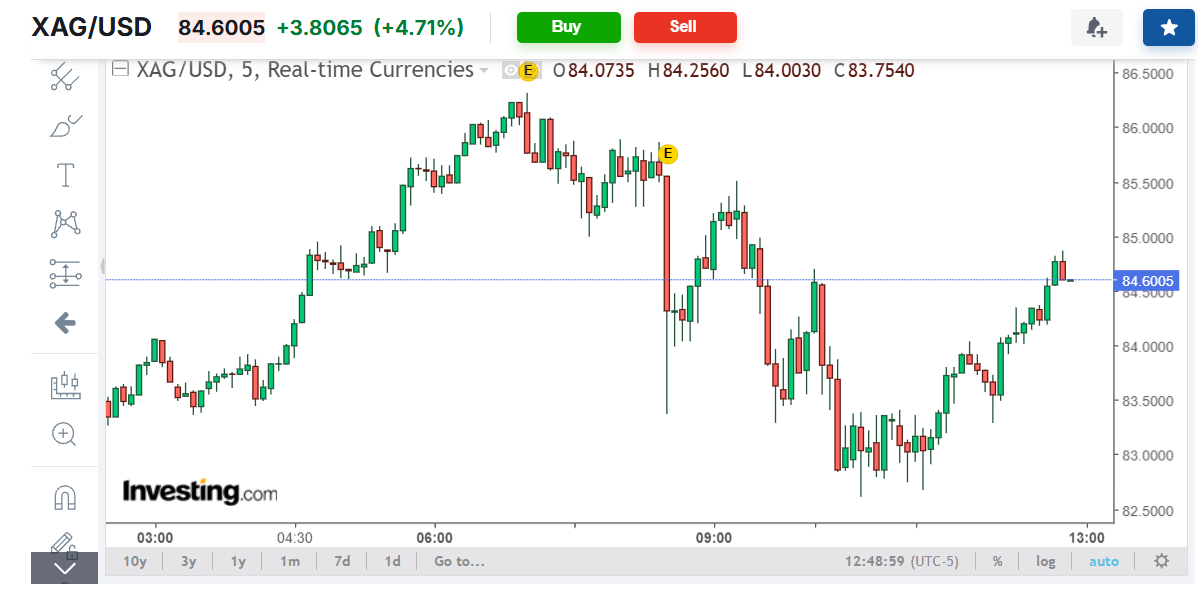

Gold & silver were smashed on the jobs headline, but have now have reversed off the lows, and are retracing much of those losses.

Gold is back over $5,100 and attempting to confirm its breakout as we speak.

Silver has rebounded by $2 back over $84.50.

Today’s job numbers are a farce. Gold & silver reflect reality.

Buy physical assets like gold & silver or be left behind.