In this EXCLUSIVE INTERVIEW, the GoldFix Publisher Vince Lanci dissects the SILVER WAR Between JP Morgan & China.

We’re Not Going Below $70 for Any Appreciable Amount of Time Anytime Soon!

Jon: Welcome to the SilverTrade Insider! I’m Dr. Jon Lindau, and joining me today Is the Silver Ghost himself- and the author of the incredible GoldFix Newsletter on Substack– Vince Lanci!

Thanks for joining us Vince!

1. Let’s start off with an overview of the last 6-12 months here Vince.

Gold broke out last spring and vaulted from around $2,800 to as high as $5,600 at the end of January.

Silver started moving a bit later, but essentially did a 4X from $30 to $120.

What ultimately triggered these massive moves in gold and silver- and are the fundamentals that triggered these moves still present?

Vince: Let’s focus on silver, because it’s more fun to talk about right now.

CONVERGENCE OF DEMAND HITTING UP IN SILVER- at the same time you have an AWARENESS OF SUPPLY BEING IN SHORTFALL.

The market became PAINFULLY AWARE that there isn’t enough available silver above ground when the LBMA ESSENTIALLY DEFAULTED! That’s what they did!

The WHOLE THING STARTED with the LBMA not being able to make delivery.

When the LBMA stopped being able to make delivery, it also became obvious that the LBMA does not have the silver available that they said they did.

At the hub of the LBMA, inside the physical silver – there’s an inter dealer market. The inter-dealer market is where these guys face each other. They say, “Can I borrow some silver from you?” And they borrow it, and they use it for their deals. So, I’m short silver, a customer buys it from me, I borrow it from JP Morgan. And then I have to pay them back in a couple days or a couple weeks.

The silver that they lent to each other in that little 5 bank hub was like you borrowing a cup of sugar from your neighbor, and saying I’ll get it back to you tomorrow.

So the lease rates are a very friendly, “buddy, buddy” environment.

My understanding is THAT SEIZED UP. THEY STOPPED LEASING TO EACH OTHER in the hub. That meant they had to go outside the hub and start to lease publicly. When they did that, you saw the lease rates EXPLODE. The lease rates exploding told you there was a real problem, and sure enough, it manifested.

In October we had that first massive run-up which ran into Thanksgiving. There’s your demand, and there’s your lack of supply coming together. So you have ETF demand now competing with industrial demand.

Industrial demand is in China. ETF demand is in China as well as in the US. You have a lack of above ground supply, because we’ve been in deficit for 5 years. If you’re in deficit for 5 years, you’re depleting above ground stocks.

The LBMA is OUT of above ground stocks. Lease rates EXPLODED, and that was your first level. Which ALSO coincided with August. In August 2025, silver started to take off again.

Jon: Let’s talk a little bit about what happened in August that might have been the trigger for the whole move: it was the critical minerals news.

Vince: Yeah, it’s funny because we had about 4 months between April 2025 and August where gold did nothing. And silver too. During those 4 months, I noticed that miners started to rally. Gold was sideways to slightly bearish between April and August.

And then in August, the US Government released its new Critical Minerals List.

And Silver was on that list! It wasn’t a done deal back then, it was, “We’re considering it”. They had never considered it before. When you looked closely at that list (which I did), EVERY METAL was on that list!

You could tell we were in a GLOBAL WAR- A MINERAL WAR! A conflict war over minerals!

Around that time you had gold break out on August 26th, you had the miners appreciate, you had the problem in silver in London, and then you have the US listing silver as a critical mineral.

That’s what happened, and you had silver go from $30 to $40, from $40 to $50- paused at $50, and then we took off!

Jon: Yeah, there was TONS of retail selling of silver at $50. The refiners were backlogged, and they stopped accepting 90% – before the real move in silver even began, the US refineries were backed up for a year!

Vince: It’s true, and it’s eyebrow raising when you have so much silver being processed at the refinery level, and yet price is going up. Historically when the silver is backlogged, they don’t have a problem selling it down. But my understanding is that a lot of the bullion banks were no longer as free to short rehypothecation paper as they had been.

So even though we had a lot of silver being processed we had no silver coming out.

When silver hit $50, two things happened:

1. Every boomer, GenX, and their mother found their old silver coins, and sold them.

So every coin dealer was inundated with junk silver.

They’re the irrational sellers. We’ve all done that at some point. “I’m just happy to get my money back, even though its 10-15 years later.

The producers do that as well. Imagine being a producer in 2011, and NOT SELLING when it’s trading at $50. When it gets there again, if you don’t sell, you’re gonna get killed by your shareholders! And so, my understanding is that selling CAME OUT OF THE WOODWORK AT THE PRODUCER LEVEL- a lot of Latin American producers started to sell & hedge. The market went sideways for a bit, and then it just took off after that.

In October, we started pulling concentrate from Latin America. It caused a PANIC in China.

All that concentrate that had been going to China, JP Morgan STARTED PULLING IT INTO THE US! So the refineries were all backed up with concentrate for a prioritized customer (JP Morgan). They were backed up casting bars for the COMEX – maybe LBMA.

Then you had all this junk coming in, and the coin dealers are choking on it- they have all their cash tied up in the “junk”. You can’t get paid by the refiner because he’s backed up- so the whole supply chain kind of seized! Wouldn’t you say?

Jon: Yeah, and I would in that I think the credit limits were a main contributor. Not only do you have the refiners backed up, but you have the underlying asset going up 2x, 3x, 4x.

Think about the capital required to maintain your inventory. It went up 4x just in the underlying price of the asset- not to mention any premiums or anything.

Vince: And on top of that, you have repo, and the people who run the repo can just change the contract rules at anytime, and rug pull you! So you have no money available, you’re silver rich, you’re cash poor, you can’t get the product out the door to get refined, so you can’t pull a new product to sell. So here we are looking at the screen, going, “They don’t have any coins! There must not be any silver!” At the same time, they don’t have any money to buy the coins because it’s tied up in everyone’s junk!

I saw an email from Rand- the trader at Stonex- we posted it on GoldFix- saying, ‘We’re not the Federal Reserve, I’m not gonna buy everything that you want to sell, I’m here to make money for Stonex.” He used to be the market maker for Amark and he went to Stonex.

His statements were symptomatic of the industry seizing up! You would know more about this than I do, but it would seem that the silver market was BUILT to function under $30!

Everyone’s relying on their just-in-time supply chains, capital requirements, and then when it POPPED above $40, $50, $60, $70, we don’t have enough refiners, and we don’t have enough capital. So the WHOLE THING SEIZED UP!

Jon: The whole retail industry in the US are hedged for dollars. They don’t want the price to go up, because they’re hedged short every single oz in their inventory!

Vince: You’re running your business, you’re not speculating on silver. Which didn’t work once silver went above $30!

Jon: When I co-founded SD Bullion, we hedged for ounces, not for dollars. So if the price of silver goes up, great, I can replace those oz for what I just sold them for.

Vince: Interesting that you say you hedged for oz, not for dollars. That mindset- hedging for dollars- comes from an industry that has been in poverty for too long.

They’re saying, I need to hedge for the money that I need, so I can make payroll, so I can buy my next batch.

They start getting comfortable getting 100% hedged. They don’t think about a reserve for an emergency. They think the supply chain’s always gonna be there!

I’ll take the silver, I’ll hedge the silver, I’ll flip the silver, I’ll get it back. And they’re not hedging for oz, they’re hedging to avoid having cashflow problems because they assume that the silver will always be there!

The chain affect in the supply chain was just boom, boom, boom, all the way up!

There’s not as much silver available at the LBMA, that means lease rates are going up. But meanwhile, all your refineries are backed up! And you’ve got everybody boomer and GenX selling their stuff!

The industry is in SORE need of working capital!

That brings us to China. China started to panic around the same time!

Jon: There were rumors that China loaned the LBMA 30 million oz in October to send to India. And if you watched the inventory numbers from Shanghai, the numbers seemed to indicate that.

Vince; In terms of rumor, speculation, conjecture, fact- I would put this at conjecture now.

What happened- what the speculative people were saying- myself included- was that, It’s interesting- the LBMA problem went away after October. I was saying that’s a quarterly problem, let’s see what happens.

Then there’s Eric Yeung, who I have a good professional relationship with. We were talking about it offline. I said, well 90 days- that problem’s going to come back, unless the silver is actually out there. Who lent the LBMA the silver? We both suspect it was China.

But what was the LBMA doing with the silver? Why was the silver NOT staying in their vault?

Well the joke was that the LBMA leased the silver from China to Dropship it to India!

It buys them time! That means the LBMA has 90 days to get that silver back.

And they started to get it back! The silver started to go up! That’s because they were returning it! And then they ran out! They didn’t have any more to give them!

So China is SHORT! China has responsibilities, and now we roll into Thanksgiving and Black Friday, and then the whole thing just turns to s*&t!

Jon: Let’s talk about Black Friday. JP Morgan pulled 13 Million oz off the COMEX. Were they keeping that from China?

Vince: Yes! The answer is yes. My opinion was speculative, but I talked to someone on the refining side, the minting side, and someone on the coin side.

Right away I’m like, who’s doing that? Who’s taking the silver that’s Registered, and making it only Eligible. And the answer- the CME said, “It’s JP Morgan!”

Well OF COURSE IT’S JP MORGAN! THEY ARE THE SILVER MARKET! IT’S ALWAYS JP MORGAN– Going back to Blythe!

I put on my Columbo hat, and reverse engineer what happened during that Black Friday aftermath.

Essentially, this is from 2 other reliable sources: a Chinese industrial was short silver on his own exchange! That Chinese silver short tried to hedge on the COMEX and take delivery! And JP Morgan said NOPE!! NOT GONNA HAPPEN!

One of my sources said he believes that JP Morgan said, No you can’t have this silver, but we’ll get the silver for you.” You roll it out, and we’ll give you 30 or 90 days.

During that 30-90 days, JP Morgan was BUYING SILVER FROM CONCENTRATE – THEY’RE FILLING AN ORDER FROM CHINA AFTER SQUEEZING THEM! That’s basically what they did! Good ole JP Morgan! Good thing they’re not against us today!

That’s what happened!

I was watching the Tape in China! As soon as JP Morgan said NO…as soon as the CME shut down for cooling issues- China went LIMIT UP. China went LIMIT UP because of a short covering order. The market just couldn’t handle it.

AT THE SAME TIME, when silver hit $70- China industrials went into Latin America, and said, hey, we want to buy silver concentrate. Latin America was like, Sorry, JP Morgan’s buying all the concentrate!

And China said, well, we’ll pay $80! $10 over!

This LatAm producer shared this info with Chris Marcus. At that point we knew China was short! After being bullish, China was short! They’re just SO ADDICTED TO EASY SILVER!

Silver has been manipulated for SO LONG that the Chinese are the ones buying the dip. They’ve been doing that for the last 5 years. And THEY GOT ADDICTED TO CHEAP SILVER, and all of a sudden the banks just reversed their mindset, and China got caught short!!

You have JP Morgan pulling concentrate from LatAm. You have JPM contracted to sell silver to China. You have China panicking. And you the LBMA saying, We don’t have any! We sent it all to India! So you have a recipe for a SHORT SQUEEZE! And we got a BIGGER short squeeze!

Then you have the UBS fund which makes things even worse!

China’s market structure screwed this up! They messed this up!

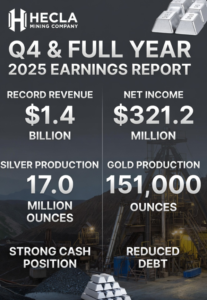

Jon: Yeah, and there’s a couple of pieces of info this week that tie into that. First Majestic released earnings, Hecla released earnings, and both of their average realized silver price for Q4 was about $70 – $15/oz higher than the average silver futures price for Q4 which was about $55!

Vince: There you go, there’s your proof! I had not seen that! That’s a good catch!

There’s our evidence! As the sleuths that we are, that Yeah- China was Short Squeezed!

The question now is- where to from here?

But then it just got worse- because of China’s market structure with that fund!

China’s LOF- Listed Open End Fund- it can trade above Net Asset Value. And it did by 30%.

This where we get into the whole Bian. The structure of the fund was faulty.

In China, there was infighting going on I believe. This comes from other influencers like @orientalghost – guys who were bullish silver all of a sudden turned neutral to bearish silver. The reason is because within the silver community in China, there were 2 factions- industrialists & investors. The industrialists wanted silver to go back down so they could cover their shorts. They had obligations. Meanwhile the speculators/ investors were at the UBS fund saying, Lets buy more! They were just driving the price up! Eventually the industrialists cried to the CCP, and said, you’ve gotta stop this! So China stepped in on January 30th, and SHUT DOWN the UBS Fund when silver was UP.

They didn’t shut down the fund when silver was down! They went from saying Please stop buying! To LIQUIDATION ONLY! Something that the Hunt Brothers know about!

And then after LIQUIDATION ONLY it became, well, we need to stop the market from going up. Then all of a sudden this guy Bian Ximing comes out – Zhongcai Futures – he was the guy who believe it or not- took on JP Morgan in 2023-2024 in gold. He comes out bearish.

It’s almost like he’ s representing the Chinese industrialists being bearish. Silver craps out. Shanghai can only go down 17%. We don’t. Silver is down 30% here. All the people in that fund are trapped. The fund breaks. Shuts down. They have to give them all their money back. Well they don’t have to, but they did. And the whole thing is a disaster.

You would THINK this would break the silver market! It did in 2011! It did with the Hunt Brothers! But this didn’t! It actually kind of bolstered the demand for silver.

I circle back to what you said about First Majestic.

Yesterday, Silver Wheaton cut a deal with BHP. They cut a deal that pretty much PEGGED SILVER TO $70! You have a BIG STREAMER agreeing to BUY SILVER at $70-$75!!

It’s a MASSIVE DEAL! $3.6 Billion!! For Silver Wheaton to COMITT?? Maybe they’re top ticking the market, but I don’t think so! When you have First Majestic releasing earnings selling silver at 26% ABOVE the silver price, when you have the spot market trading above the futures market, when you have backwardation, when you have Silver Wheaton doing that, I think this market is JUST GETTING GOING!

My good friend David Morgan doesn’t believe that the bullion banks are long now.

But I believe that the US is in the silver market HOARDING. JP Morgan is buying silver for the US market! It ties in with Price Floors being raised!

I have a position on that we’re not going below $70 for any appreciable amount of time anytime soon!

Jon: I’ve dubbed it World War Silver. Do you agree that it’s a war against China?

Vince: It’s funny you say it that way. Because Bian- he was on the right side of the gold trade.

April of 2024 gold started to take off. That’s when he took JP Morgan out to the woodshed. JP Morgan had to make delivery in China. So a bit of an adversarial relationship was formed.

It’s really a proxy war. This Bian guy is really a proxy for the PBOC, and JP Morgan is really a proxy for the Fed. It’s almost like we’re at war with them!

Silver is the Canary in the Coalmine! It shows there is a problem with China! It’s manifesting in oil now- we went into Venezuela- we’re trying to throw China out of South America!

Silver is the First Thing that Bleeds! I think we’re in for a great market! It’s not done at all!

I am very comfortable in saying silver is between $150-$200 within the next 4 years.

I’m not gonna say it’s going to happen in the next 4 days. But I’ll take that return.

Vince Lanci is the publisher of the GoldFix newsletter.

You can follow and subscribed to Vince’s extraordinary work at Gold Fix:

GoldFix | VBL | Substack

as well as follow him at X: https://x.com/Sorenthek