Silver production totaled 17.0 million ounces

Revenue Exceeded $1.4 BILLION

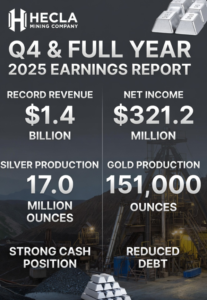

Hecla Mining Company (NYSE: HL) released its Q4 and full-year 2025 earnings results today, marking a standout year for the leading U.S. silver producer.

For the full year 2025, Hecla achieved record performance across key metrics:

Revenue exceeded $1.4 billion, up 53% from 2024.

Net income applicable to common stockholders reached $321.2 million ($0.49 per share), a nine-fold increase year-over-year.

Adjusted EBITDA hit a record $670 million, nearly double the prior year.

Silver production totaled 17.0 million ounces (at the high end of guidance), with gold at 151,000 ounces (also exceeding targets).

The company generated strong cash flows, reduced total debt by 50% to $276 million, slashed net debt to $34 million, and ended with $242 million in cash and a net leverage ratio of just 0.1x.

All operations were free cash flow positive, with record output at Lucky Friday (5.3M oz silver) and Keno Hill’s first profitable year under Hecla ownership. In Q4 2025, results remained robust amid higher metal prices:

Revenue surged to $448.1 million (up significantly YoY and beating estimates).

Net income applicable to common stockholders was $134.3 million ($0.20 per share), with adjusted figures also topping expectations.

The quarter benefited from strong contributions across mines, including Greens Creek and Lucky Friday.

Hecla declared a quarterly cash dividend of $0.00375 per common share (payable March 24, 2026) and $0.875 per Series B preferred share. Looking ahead, the company is positioning as North America’s premier silver producer following the pending sale of its Casa Berardi gold mine (up to $593 million, expected close in Q1 2026).

2026 silver production guidance is set at 15.1-16.5 million ounces, with plans to nearly double exploration and pre-development spending to $55 million.

CEO commentary highlighted 2025 as “transformational,” with strengthened operations, balance sheet, and focus on silver growth.

This release underscores Hecla’s operational strength and strategic shift in a favorable precious metals environment.