MASSIVE $429M Call Option Placed on SILJ Moments Before Friday’s Close!!

Did a Bullion Bank Just Buy $429 MILLION in SILJ Silver Miner ETF Calls After Receiving a MARGIN CALL on its Naked Short Silver Position??

Here’s what we know: 17 non-US banks were net short 43,084 COMEX silver contracts – (215.42 MILLION oz) prior to silver’s parabolic move higher…and reportedly short HUNDREDS OF BILLIONS of oz via the OTC derivatives market.

*On Christmas Day, the physical price of silver shot past $80/oz in Shanghai.

That afternoon, SilverTrade warned readers that if COMEX allowed US silver prices to chase Shanghai price setting into the $80’s, it would immediately DETONATE the global bullion banks’ derivative books.

*Once Globex trading resumed Christmas night, silver futures prices gapped higher from $72 to over $74.

The silver squeeze had begun.

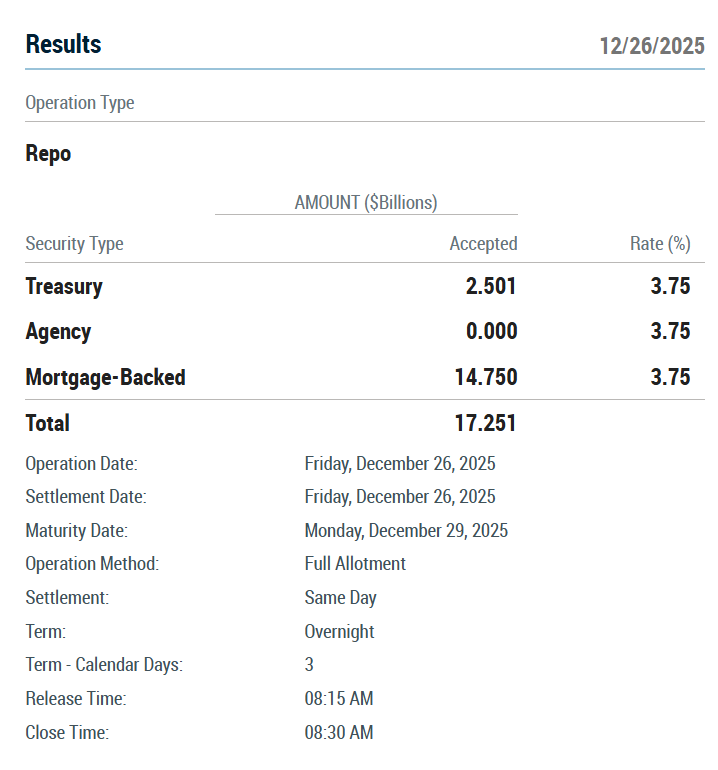

*At 8:30 Friday morning, the first signs of major stress in the banking system appeared as TBTF banks tapped the Fed’s Repo Facility for $17.251 BILLION in emergency liquidity.

*As trading progressed Friday, Silver Prices EXPLODED 11% higher on the day, from $71.03 up to $79.70. Silver CLOSED even stronger in Shanghai at $84.97!

*Later Friday afternoon, rumors began swirling through the market that a large bullion bank was unable to meet a massive MARGIN CALL it had just received over its naked short silver position.

This means the silver short position would be LIQUIDATED.

Unrealized losses immediately MARKED TO MARKET.

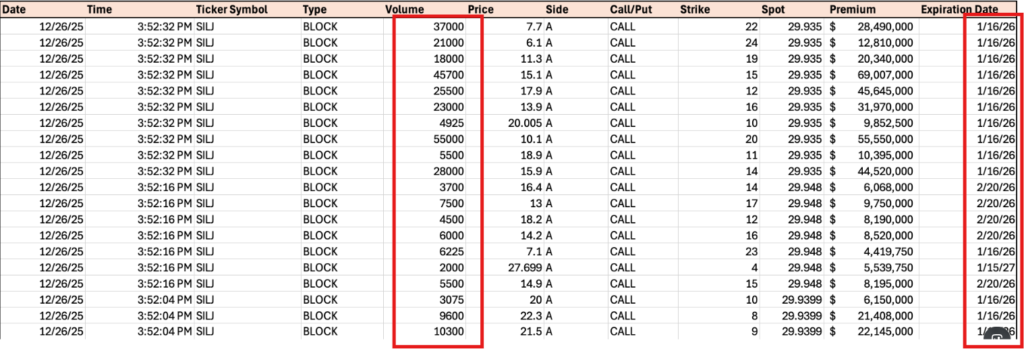

*At exactly 3:52 pm EST Friday, someone bought $429 MILLION of Silver Miners ETF $SILJ Calls, the majority expiring in only 3 weeks- January 16, 2026.

Only 8 minutes before the close, after silver had ALREADY soared to nearly $80/oz, someone placed a GARGANUTAN $429 MILLION BET on JUNIOR SILVER MINERS placing a huge rally within the next 3 weeks.

Let’s put this number in perspective:

The ENTIRE MARKET CAP of SILJ is $2.67 Billion.

A single entity placed a MASSIVE DIRECTIONAL $429 M BET ON THE SILJ SILVER JUNIOR MINERS ETF with a $2.67 B market cap THAT EXPIRES IN 3 WEEKS.

8 minutes before the close.

After a large bullion bank naked short silver reportedly received a margin call it couldn’t meet over its silver short position.

*Knowing that it couldn’t meet its end of day MARGIN CALL in 8 minutes- meaning its legacy silver short position would be LIQUIDATED the moment silver futures resume trading Sunday night – and KNOWING that liquidating its MASSIVE naked short silver position would cause the MOTHER OF ALL SHORT SQUEEZES, did this bullion bank attempt to save itself from IMMINENT INSOLVENCY by placing a massively leveraged LONG BET on the SILJ Silver Junior Miners ETF?

Because this bank KNOWS that global silver prices are about to be MASSIVELY repriced higher as the bullion banks have lost control of the silver market, and their naked short silver positions are being FORCE LIQUIDATED???

These are the facts.

Are we looking at a strange string of coincidences?

Or is a large bullion bank’s legacy silver short position about to be LIQUIDATED the moment trading resumes Sunday night?

Make your own conclusion.

SILJ Call chart courtesy @SubuTrade