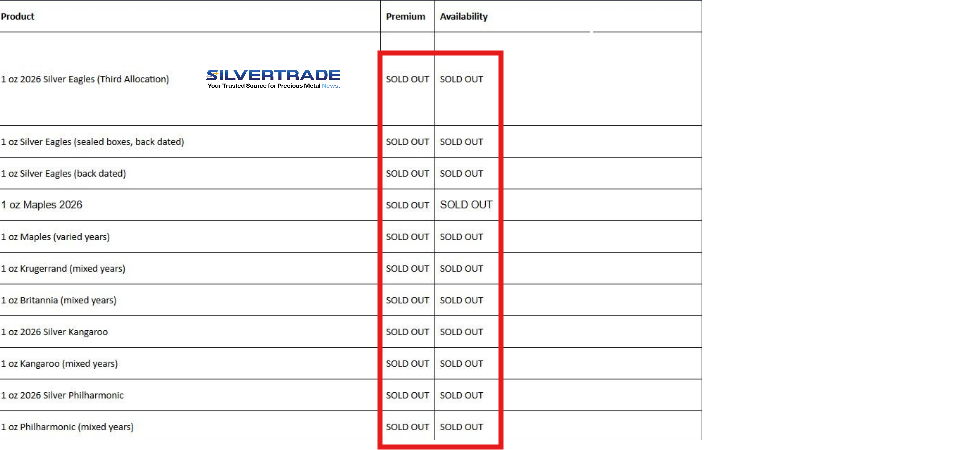

We were sent the wholesale silver trade sheet from one of the US Mint’s AP’s this morning:

🚨EVERY SINGLE PHYSICAL SILVER PRODUCT IS SOLD OUT!!

🔥One of the main wholesalers who purchase directly from the US Mint are literally not even accepting orders for a SINGLE PHYSICAL SILVER PRODUCT!🔥

🚨YET MULTIPLE PHYSICAL SILVER RETAIL PRODUCTS HAVE SUDDENLY GONE NO BID!

This is NOT due to a lack of demand for silver, but due to a LACK OF CAPITAL at the largest wholesalers & brokerages in the country!

From the info we are hearing from our sources inside the wholesale & retail silver bullion industry in the US, it appears that all of the major US precious metals wholesalers are maxed out on their credit lines to the point where they are NO BID on silver products- yet they have no stock to sell at the same time.

Forget the bullion banks- it looks like silver is beginning to break the wholesale silver market itself!!

Many of these institutions have MAXED OUT their credit lines financing retail silver buybacks & sending metal to refineries, combined with the cost of losses sustained shorting their entire book in the silver futures market.

Many of these institutions have MAXED OUT their credit lines financing retail silver buybacks & sending metal to refineries, combined with the cost of losses sustained shorting their entire book in the silver futures market.

Most of the US wholesale precious metals dealers short their entire gold and silver book, to maintain a net neutral position in the metals.

(Meaning they make money on the buy/sell spreads alone- they attempt to have zero exposure to the actual metal.)

(Meaning they make money on the buy/sell spreads alone- they attempt to have zero exposure to the actual metal.)

As silver prices have quadrupled, the cost to short their entire book of HUNDREDS OF THOUSANDS TO MILLIONS OF OZ of physical silver via COMEX futures has risen exponentially and has EATEN UP THEIR FIXED CREDIT LINES. 🚨

🚨Ironically, the entire US wholesale PM industry is now getting EATEN ALIVE by silver itself because of the brokerages’ decisions to SHORT their entire gold & silver book instead of maintaining a fixed OUNCE position!!

Nearly all of the brokerages and wholesalers who depend on precious metals for their living TIED THEIR FATES TO THE FIAT DOLLAR INSTEAD OF PRECIOUS METALS!!

Silver at $95 is becoming too expensive to maintain normal operations & is triggering UNPRECEDENTED FINANCE LIMITATIONS at the largest of the large US wholesalers and brokerages!