China’s Quiet Currency Offensive: Printing Yuan to Dominate Global Resources and Undermine the West

In an era of escalating geopolitical tensions, traditional warfare with tanks and missiles is giving way to subtler forms of conflict—economic maneuvers that reshape global power without a single shot fired.

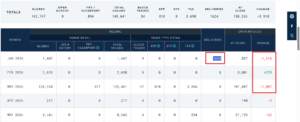

China’s recent monetary expansion, marked by a ¥25.03 trillion increase in its M2 money supply over the past year, is not merely a domestic stimulus effort.

It represents a calculated strategy to flood the world with yuan-backed liquidity, enabling Beijing to hoard critical minerals, metals, and commodities.

This approach amounts to atypical warfare, aimed at crippling the West—particularly the United States—by controlling the raw materials essential to modern economies, defense systems, and technological advancement.

China’s broad money supply (M2) has ballooned to approximately ¥336.99 trillion as of November 2025, reflecting an 8% year-over-year growth.

Unlike the U.S. Federal Reserve’s quantitative easing, which often inflates asset bubbles, China’s expansion is channeled strategically. As one analysis notes, when China prints, it doesn’t pump stocks—it secures resources like gold, silver, energy, and industrial metals. @EtherGuru08

Critical minerals—silver, lithium, cobalt, nickel, rare earths, and more—are the lifeblood of electric vehicles, renewable energy, semiconductors, and military hardware. China already controls 60% of global refined critical mineral supply, and an estimated 70% of global refined SILVER supply.

On Jan 1st 2026, China began export restrictions on silver. Silver prices exploded in the months leading up to China’s new silver export restrictions, and continue to rally early in 2026.

From Africa’s cobalt fields to South America’s lithium reserves to Mexico’s silver mines, Chinese firms are embedding themselves deeply.

By controlling refining—65% globally for some minerals—China can weaponize shortages.

What elevates this from economic policy to warfare is intent. Xi Jinping’s directives emphasize increasing global dependence on China, creating “powerful retaliatory capabilities” against supply disruptions.

A “commodities cold war” is underway, with China stockpiling LNG, oil, and metals while Western institutions short silver and other assets—positions larger than annual global production.

The West’s complacency—fueled by “woke” distractions, as some critics argue—has allowed this erosion.

This yuan-fueled resource offensive threatens U.S. hegemony.

Donald Trump understands this, and has begun taking measures to strike back against China.

Trump added silver and copper among others to the US Strategic Minerals list in November, the US Gov’t announced last week that a new US smelter/refiner of silver & other critical metals will open in Tennessee- the first new US smelter in over 5 decades, and the US overthrow the Maduro regime taking control of Venezuela’s massive oil deposits.

Completely breaking China’s hold could take a decade, requiring massive investments in mining, refining, and alliances.

China’s M2 expansion isn’t just inflation; it’s ammunition in an atypical war.

The question isn’t if the West will respond, but whether it can before the yuan becomes the world’s new reserve—for resources, not just currency. This perspective, while grounded in observable trends, remains speculative. Economic strategies can serve multiple goals, from growth stabilization to geopolitical leverage. Yet, the patterns—printing, hoarding, restricting—paint a picture of deliberate asymmetry. In the resource scramble of 2026 and beyond, the West must wake up or risk being outmaneuvered.