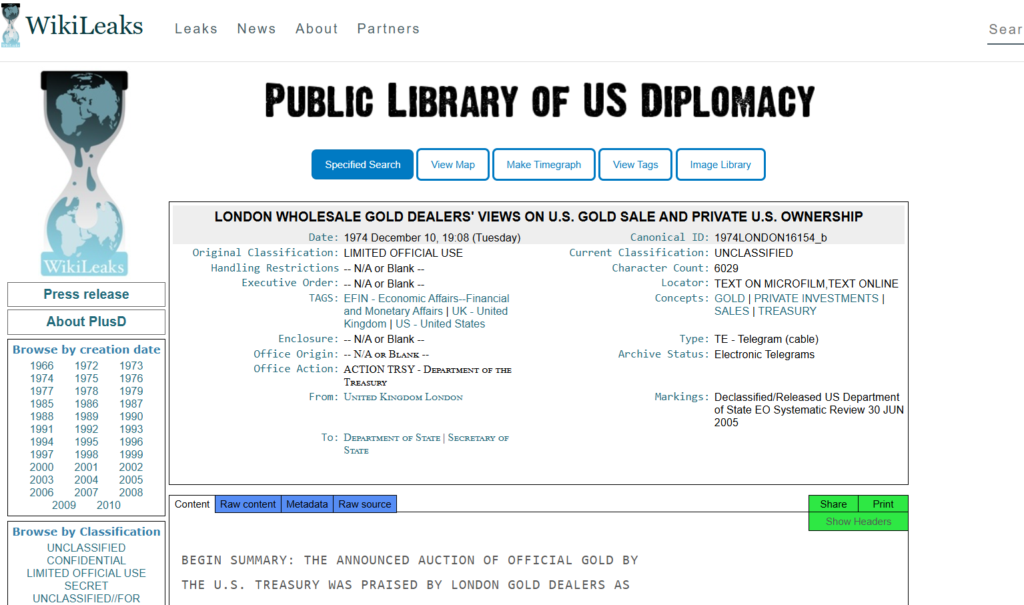

TO THE DEALERS’ EXPECTATIONS, WILL BE THE FORMATION OF A SIZABLE GOLD FUTURES MARKET. EACH OF THE DEALERS EXPRESSED THE BELIEF THAT THE FUTURES MARKET WOULD BE OF SIGNIFICANT PROPORTION & PHYSICAL TRADING WOULD BE MINISCULE BY COMPARISON.

ALSO EXPRESSED WAS THE EXPECTATION THAT LARGE VOLUME FUTURES DEALING WOULD CREATE A HIGHLY VOLATILE MARKET.

IN TURN, THE VOLATILE PRICE MOVEMENTS WOULD DIMINISH THE INITIAL DEMAND FOR PHYSICAL HOLDING & MOST LIKELY NEGATE LONG-TERM HOARDING BY U.S. CITIZENS…

SOME FEAR, HOWEVER, THAT SHOULD A SINGLE BID FOR THE ENTIRE 2 MILLION OUNCES BE FORTHCOMING, PRICES MIGHT INCREASE RAPIDLY, POSSIBLY AS HIGH AS $250 AN OUNCE.

Yet another whacky “conspiracy theory” has now been confirmed.

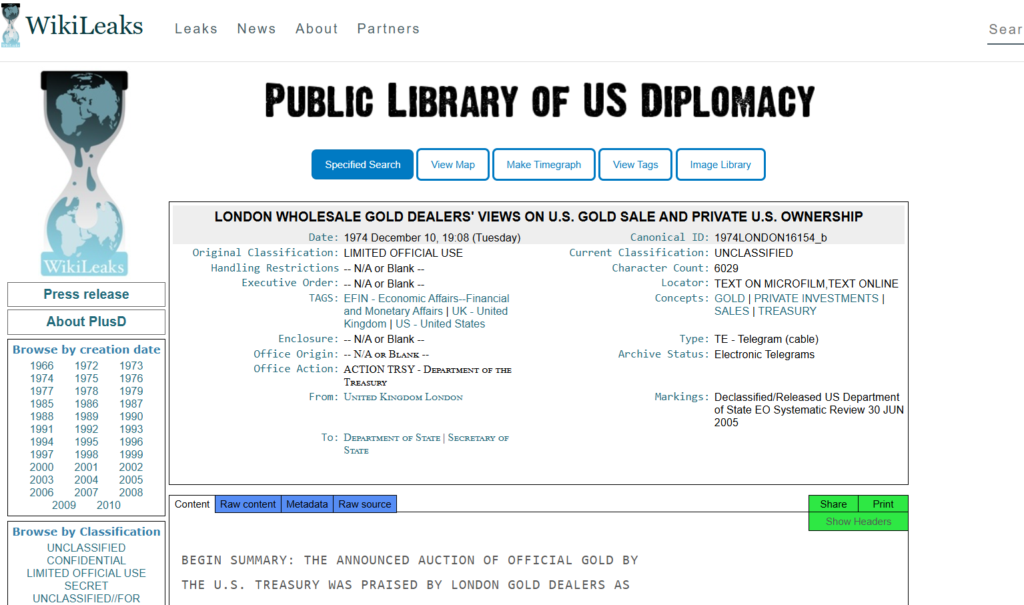

Source: Wikileaks

Yet another whacky “conspiracy theory” has now been confirmed.

We wonder why the US Treasury would want to suppress gold prices…

Full Wikileaks Text of the December 10, 1974 Diplomatic Cable below:

BEGIN SUMMARY:

THE ANNOUNCED AUCTION OF OFFICIAL GOLD BY THE U.S. TREASURY WAS PRAISED BY LONDON GOLD DEALERS AS BEING TIMELY AND HIGHLY CONTRIBUTORY TO A MORE STABLE MAR- KET. SOME FEAR, HOWEVER, THAT SHOULD A SINGLE BID FOR THE ENTIRE 2 MILLION OUNCES BE FORTHCOMING, PRICES MIGHT INCREASE RAPIDLY, POSSIBLY AS HIGH AS $250 AN OUNCE.THEY ANTICIPATE MAJOR IMPACT OF U.S. OWNERSHIP WILL BE THE FORMATION OF A SIZABLE GOLD FUTURES MARKET, BUT RATHER SMALL DEMAND FOR PHYSICAL HOLDING OF GOLD, OTHER THAN COINS, AFTER A BRIEF INITIAL SURGE FOLLOWING DEREGULATION.END SUMMARY1. IN CONNECTION WITH VISIT OF GAO TEAM SURVEYING ATTITUDE LIMITED OFFICIAL USE LIMITED OFFICIAL USE PAGE 02 LONDON 16154 01 OF 02 101915Z IN LONDON TO PRIVATE OWNERSHIP OF GOLD BY AMERICANS, ASST- FINATT OBTAINED REACTIONS FROM MAJOR LONDON WHOLESALE GOLD DEALERS (SAMUEL MONTAGU & CO., SHARPS PIXLEY & CO., LTD., MOCATTA & GOLDSMID, AND CONSOLIDATED GOLD FIELDS, LTD.) TO ANNOUNCED AUCTION OF GOLD BY U.S. TREASURY.WHILE THE UNDERLYING REASONS DIFFERED, THE CONSENSUS OF THE DEALERS WAS THAT THE MOVE BY THE U.S. WAS LAUDABLE; IN MOST CASES THEY STATED THAT THE ACTION WAS UNEXPECTED; THE TIMING OF THE DECISION WAS PRAISED AS BEING FORESIGHTED. ANNOUNCE- MENT OF THE SALE PRIOR TO THE JANUARY 1, 1975, DATE WAS VIEWED AS TIMELY SINCE THERE IS MOUNTING EVIDENCE THAT MUCH OF THE RECENT INCREASE IN THE PRICE OF TRADED GOLD HAS RESULTED FROM ANTICIPATION OF A LARGE AMERICAN DEMAND FOLLOWING THE DEREGULATION DATE, EVEN THOUGH THE DEALERS THEMSELVES EXPECT THE PHYSICAL DEMAND TO BE RATHER SHORT- LIVED.2. THIS MUCH SAID, A RECURRING COMMENT BOTH IN CONVERSA- TIONS WITH THE GOLD DEALERS AS WELL AS IN NUMEROUS TELE- PHONE CALLS RECEIVED BY THE EMBASSY IS THAT IF ONE BUYER, OR MORE LIKELY ONE BUYER FROM A PARTICULAR COUNTRY (KUWAIT WAS OFTEN CITED), DECIDES TO PLACE A BID FOR THE ENTIRE 2 MILLION OUNCES OF U.S. GOLD BEING AUCTIONED EITHER AT MAR- KET PRICES, OR POSSIBLY AT HIGHER THAN MARKET PRICES, THEN THE EFFECT OF THE U.S. AUCTION, WHICH IS INITIALLY VIEWED AS HAVING A STABILIZING FORCE ON MARKET PRICES, WOULD BE THE OPPOSITE.DEALERS STATED THAT SHOULD SUCH A SINGLE BID BE ACCEPTED BY THE U.S., THEN THE MARKETS WOULD INTER- PRET THIS AS A SIGNAL THAT HERETOFORE UNRECOGNIZED DEMAND WAS PRESENT AND PRICES WOULD INCREASE RAPIDLY, POSSIBLY AS HIGH AS $250 PER OUNCE OR EVEN HIGHER.3. IN THE DEALERS’ VIEW, THE ONLY COUNTERACTION TO THE ABOVE HYPOTHETICAL SITUATION WOULD BE FOR AN IMMEDIATE ANNOUNCEMENT OF AN ADDITIONAL SALE OF LIKE OR LARGER QUANTITIES.THE DEALERS WITH WHOM WE SPOKE STATED THAT TO DATE THERE HAD BEEN NO SIGNIFICANT ACTIVITY IN THE GOLD MARKETS BY OFFICIAL MONETARY AUTHORITIES OF ARAB COUNTRIES THEY ALSO EXPRESSED THE VIEW THAT SHOULD MARKET CONDITIONS INDICATE THAT PRICES MAY RISE RAPIDLY IN THE NEAR TERM, A LARGE VOLUME PURCHASE FROM OIL PRODUCING AREA SHOULD NOT BE TOTALLY DISCOUNTED OR UNEXPECTED.WHILE MOST DEALERS DID NOT FORESEE A LARGE ARAB DEMAND FOR GOLD TO BE HELD AS OFFICIAL RESERVES, THEY DID SEE DEMAND FROM THE OIL PRO- DUCING AREAS, WITH MIDDLE EAST RESIDENTS BEING POTENTIAL ACTIVE TRADERS IN THE GOLD MARKET, ESPECIALLY IN THE ABSENCE OF OFFICIAL SALES TO STABILIZE PRICE.IN REPLY TO QUESTION, THEY WERE NOT CLEAR WHETHER THIS TYPE OF ACTIV- ITY MIGHT COME FROM OFFICIAL AUTHORITIES OR ONLY FROM PRI- VATE SOURCES, BUT REITERATED THE IDEA THAT THE OIL PRO- DUCING AREAS WERE THE ONLY ONES WITH SUFFICIENT FUNDS TO MAKE LARGE PHYSICAL GOLD PURCHASES IN CURRENT MARKET CON- DITIONS.4. THE MAJOR IMPACT OF PRIVATE U.S. OWNERSHIP, ACCORDING LIMITED OFFICIAL USE LIMITED OFFICIAL USE PAGE 02 LONDON 16154 02 OF 02 102035Z TO THE DEALERS’ EXPECTATIONS, WILL BE THE FORMATION OF A SIZABLE GOLD FUTURES MARKET.EACH OF THE DEALERS EXPRESS- ED THE BELIEF THAT THE FUTURES MARKET WOULD BE OF SIGNIFI- CANT PROPORTION AND PHYSICAL TRADING WOULD BE MINISCULE BY COMPARISON.ALSO EXPRESSED WAS THE EXPECTATION THAT LARGE VOLUME FUTURES DEALING WOULD CREATE A HIGHLY VOLATILE MAR- KET. IN TURN, THE VOLATILE PRICE MOVEMENTS WOULD DIMINISH THE INITIAL DEMAND FOR PHYSICAL HOLDING AND MOST LIKELY NEGATE LONG-TERM HOARDING BY U.S. CITIZENS.5. AS TO FUTURE DEMAND BY U.S. CITIZENS FOR GOLD, MOST DEALERS DID NOT FORESEE DEMAND FOR PHYSICAL HOLDING AS SIGNIFICANT, WITH THE EXCEPTION OF AN INITIAL SURGE DURING THE FIRST 2 TO 3 MONTHS OF THE YEAR FOLLOWING DEREGULATION THEY DID NOT FEEL THAT U.S. CITIZENS, ON THE WHOLE, WERE PSYCHOLOGICALLY PREPARED TO SWITCH FROM SMALL SCALE GOLD COIN PURCHASES TO LARGE SCALE, LONG-TERM BULLION HOARDING.

SEVERAL EXPRESSED THE VIEW THAT THE DEMAND FOR COINS (AFTER THE INITIAL SURGE) WOULD MOST LIKELY BE SUCH THAT IT COULD BE MET FROM WITHIN SHOULD THE U.S. DECIDE TO MINT GOLD COINS FOR SUCH PURPOSES. SPIERS

For all of the deniers that the gold & silver markets are managed, thanks to Wikileaks, we now have confirmation that the entire gold (and thus also silver) futures markets were created for the very purpose of suppressing physical gold demand and capping gold prices.