On Friday, we picked up something extraordinary in the minutia of the CME’s COMEX Open Interest Data report: March silver futures contracts appeared to be ROLLING BACKWARD to January & February in order to stand for immediate delivery of physical silver.

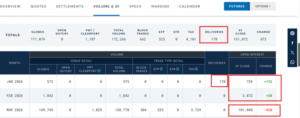

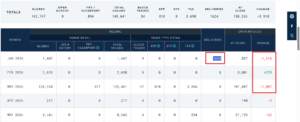

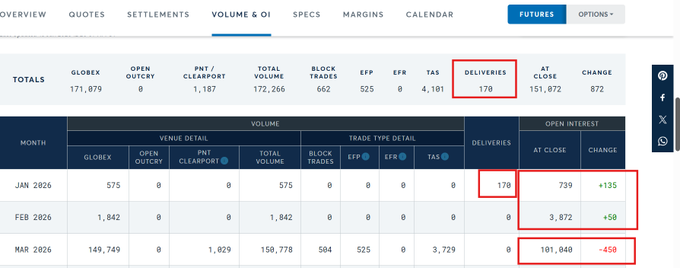

This phenomenon continued Monday, as March Silver Futures Open Interest declined 450 contracts to 101,040. It appears that 355 contracts of that 450 contract decline in March silver was ROLLED BACKWARDS to Jan/Feb!

The Jan 2026 Contract saw another 170 deliveries, yet Open Interest ended the day +135.

This means a net +305 contract move into the Jan 2026 contract on the day.

The Feb 26 contract OI ended +50 for the day.

Essentially a net +355 contract move on the day from March Silver into Jan/Feb.

Another 1,775,000 oz worth of silver longs who simply cannot wait until March to stand for delivery of COMEX silver!!

This is EXTRAORDINARILY BULLISH, and indicates the silver supply shortage continues to worsen, even as silver closes in on $100 in China, & $90 on the COMEX!!