Where There’s Smoke, There’s Usually

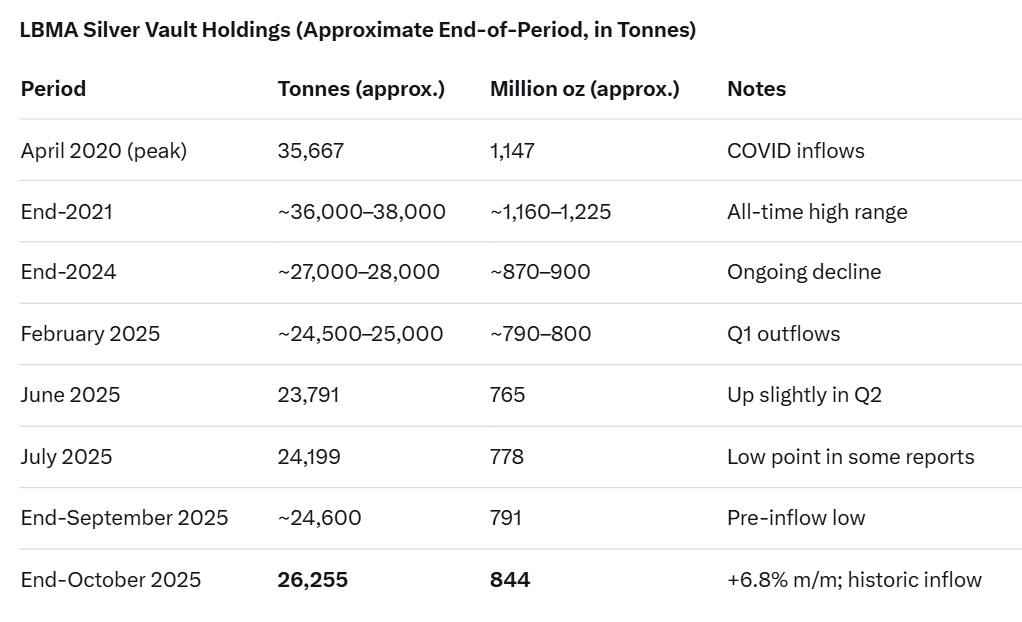

LBMA Silver Vault Holdings Trends (2020–2025)

The London Bullion Market Association (LBMA) publishes monthly data on silver held in its member vaults in London, representing the core physical backing for the global over-the-counter (OTC) silver market. These holdings fluctuate based on imports/exports, ETF flows, industrial demand, investment arbitrage, and movements to/from other hubs like COMEX (New York) or Shanghai.

Key Historical Trends –

COVID-era peak (2020–2021): Holdings surged to record highs, reaching ~35,000–38,000 tonnes (around 1.1–1.2 billion oz) due to massive physical deliveries into London amid market disruptions and ETF inflows. – although the LBMA was accused during this period of misrepresenting silver inventories (intentionally fudging the numbers by 3,300 metric tonnes), with reports in May 2021 claiming the LBMA had 3,300 tonnes more silver than it actually held in London vaults. These claims are based on concerns that LBMA figures include silver that is not available for physical delivery, such as that held by ETFs, and fail to reflect the “free float” of silver. 2022–2024 decline: A multi-year downtrend began as silver flowed out to meet rising industrial demand (especially solar/electronics), ETF outflows in some periods, and arbitrage to higher-premium markets. By mid-2025, stocks had fallen ~50% from the 2020 peak. 2025 developments: (tightness followed by replenishment- if the official LBMA reports are not still being intentionally doctored): Early 2025: Continued draws, with significant outflows in Q1 (e.g., ~4,000 tonnes withdrawn Dec 2024–Feb 2025). Mid-2025 (summer): Stocks hit multi-year lows around 23,000–24,000 tonnes amid strong industrial/ETF demand and structural global deficits. July 2025: ~24,200 tonnes. Late summer/autumn 2025: Extreme tightness (“silver squeeze”) drove lease rates to record highs, with “free-float” (immediately available) silver critically low (~155 million oz or less in Sept/Oct). Silver lease rates exceeded an astonishing 40% during this period, signifying the extent of the physical shortage in the global market.Longer-term, LBMA silver stocks are still well below COVID peaks but have stabilized/recovered from 2025 lows according to the official LBMA data. Rumors persist throughout the market that the LBMA has not yet delivered ANY silver to India that was purchased in October – which could explain how the LBMA’s silver inventory numbers supposedly jumped in October despite a global silver supply squeeze which saw lease rates in excess of 40%. For now, the LBMA survives on COMEX & Shanghai withdrawals, but China has clamped down on this with silver export restrictions that go into effect January 2026.

President

Trump would be wise to do the same likewise for the US, and impose export restrictions on the critical and strategic metal known as silver.Inventory stress in the physical silver market has been smoking for months.

Where there is smoke, there is usually fire!!