5-ALARM SILVER FIRE?

It appears that we are looking at a systemic banking crisis straight in the face.

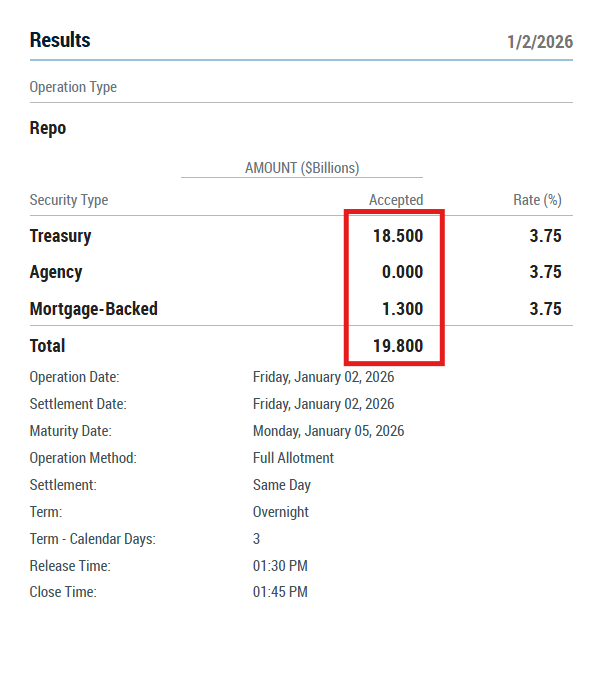

After TBTF banks took down $74.6 in EMERGENCY LIQUIDITY from The Fed on New Year’s Eve, https://x.com/silvertrade/status/2006377268768084292 , the banks have just tapped The Fed’s Repo Facility for ANOTHER $19.8 BILLION Friday afternoon!

We wrote on Christmas Day that if silver was allowed to GAP UP to $80/oz to match China’s silver price, it would DETONATE the bullion banks short silver.

https://silvertrade.com/news/precious-metals/silver-news/could-silvers-explosion-to-nearly-80-trigger-a-banking-crisis-this-weekend/Last Friday, as silver skyrocketed from $71 to $79/oz, & The Fed’s Repo Facility was tapped for $17 Billion, we asked whether one of the large bullion bank’s silver shorts were being LIQUIDATED after reportedly being unable to make a margin call.

Based on the events at the Fed’s Repo window as this week has progressed, it is starting to look like we are witnessing the fall-out of that DETONATION from behind the curtain in real time.