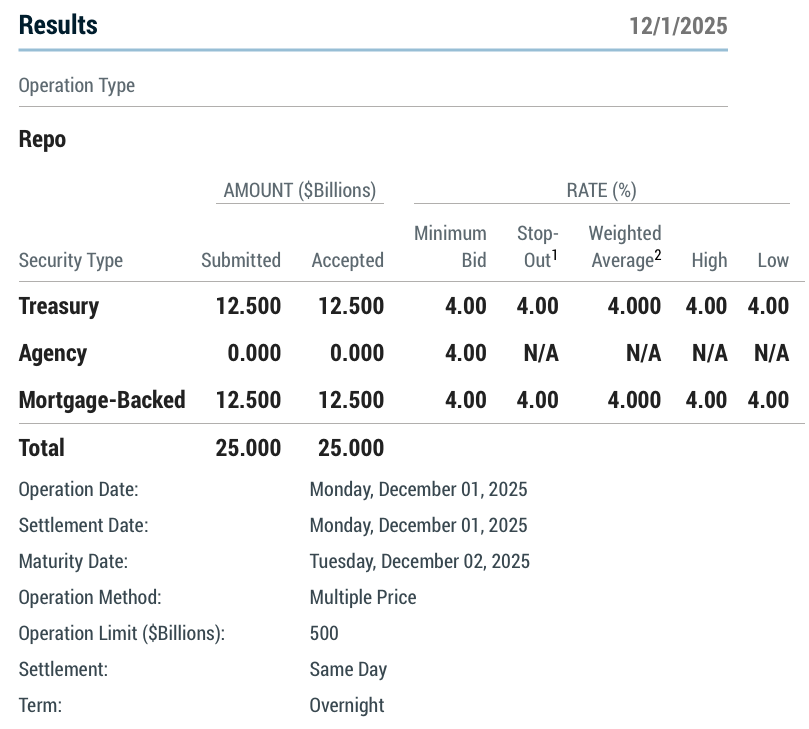

The Fed Standing Repo Facility Was Tapped for ANOTHER $25 BILLION Monday Morning!!

As most of our readers are well aware, on Thanksgiving night, the CME halted all futures trading for 10 hours, just as the price of silver was breaking out to new all-time record highs.

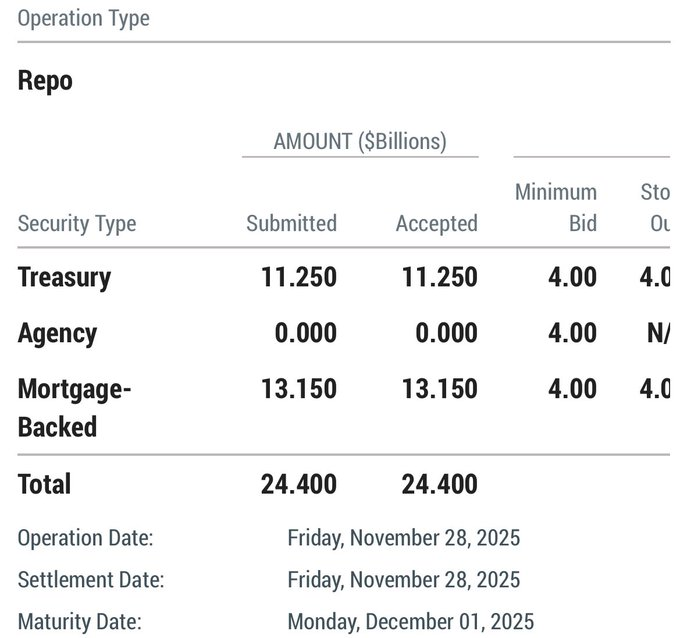

The CME claimed a “cooling issue” had forced them to shut their servers for hours…but coincidentally, the CME resumed trading JUST AFTER 8:30 am EST, when the Fed Repo Facility was tapped for $24.4 BILLION in emergency liquidity:

$49.4 BILLION in emergency liquidity injected into the banking system over the past 2 business days- coinciding with a massive SHORT SQUEEZE in silver!

Where there’s smoke, there’s often fire.

Are the bullion banks’ silver short positions BURNING THEM ALIVE!?!