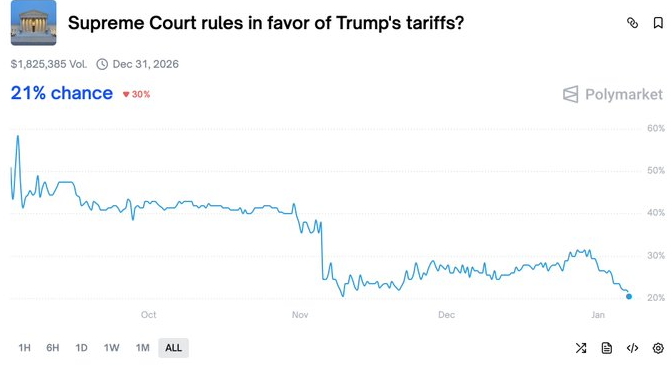

The SCOTUS is expected to rule on the Trump Administration’s Tariffs on Friday.

The market expects SCOTUS to rule against Trump, with Polymarket odds currently showing a 79% chance that Trump’s Tariffs will be struck down:

The question on all precious metals investors minds is How might The SCOTUS overturning US tariffs affect gold and silver prices?

The SCOTUS ruling striking down Trump’s use of the International Emergency Economic Powers Act (IEEPA) to impose broad tariffs would likely introduce short-term market volatility and uncertainty, as the administration has signaled plans to quickly reimpose similar measures under alternative legal authorities, such as national security provisions or trade acts.

This could temporarily weaken the US dollar further (which has already been declining in early 2026 amid tariff-related concerns) and boost safe-haven demand for precious metals.

Over the medium term (3-6 months), reduced tariffs might ease inflation pressures and support stronger economic growth, leading to higher interest rates and a rebounding USD, which could exert downward pressure on gold.

Silver, which has both safe-haven and industrial demand components, might experience a more muted upside initially (perhaps 5-10% gains) driven by uncertainty, but could benefit longer-term from improved global trade flows and manufacturing activity if tariffs stay lowered, offsetting some safe-haven outflows.Industrial uses in electronics and renewables could prop up prices if supply chains stabilize.

We don’t expect the Trump Administration to take the SCOTUS ruling lying down however- we expect Trump’s team is already preparing multiple other legal avenues to pursue his tariff policy. So ultimately, the long term impact is likely to be negligible, assuming Trump reimplements the struck down tariffs under another avenue.

The real risk of volatility could be SCOTUS surprising the market, and siding with the Trump Administration over tariffs. Such a decision could shock the bankers and the market, triggering a massive move in the metals similar to what occurred in the spring of 2025.

Regardless of Friday’s SCOTUS decision, the fundamentals for gold and silver have not changed.

Central banks are moving away from the US Dollar and towards gold as the primary reserve asset, M2 remains elevated, particularly in China, US Federal Deficits continue to rise exponentially, and the global government bond market bubble is in a slow motion train wreck collapse.

We expect the long term secular bull market in gold and silver to continue until the fundamental drivers of the move change.

We suspect this will not occur in 2026.