Samsung’s pursuit of next-generation battery technology has led to a breakthrough in all-solid-state batteries (ASSBs) that incorporate a silver-carbon (Ag-C) composite layer in the anode.

This innovation, first detailed in a 2020 Nature Energy paper and advanced through ongoing development, promises superior performance over traditional lithium-ion batteries.

As of late 2025, Samsung SDI has confirmed progress toward commercialization, with prototypes demonstrating exceptional metrics and plans for mass production targeting premium electric vehicles (EVs) by 2027.

Silver is Always Better: Key Features of Samsung’s Silver Solid-State Battery

Samsung’s ASSB design replaces flammable liquid electrolytes with a solid (often oxide- or sulfide-based) electrolyte, enhancing safety by reducing risks like thermal runaway and dendrite formation.

The thin (5 µm) Ag-C composite anode layer is central to these improvements:

- Energy Density — Up to 500 Wh/kg (nearly double the 270 Wh/kg of mainstream lithium-ion batteries), enabling smaller, lighter packs.

- Range — Approximately 600 miles (966 km) on a single charge for EV applications.

- Charging Speed — Full charge in as little as 9 minutes (or 80% in similar timeframes).

- Lifespan — Up to 20 years or over 1,500 cycles with minimal degradation.

These claims position the technology for “super premium” EVs initially, with broader adoption potentially following cost reductions. Samsung is also collaborating with partners like BMW and Solid Power on validation projects, signaling real-world testing progress.

|

Impact on the Global Physical Silver Market

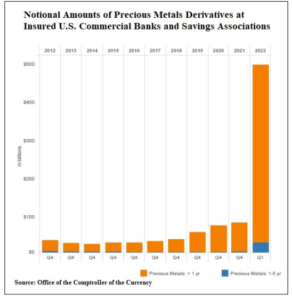

Silver is already in a structural deficit, with industrial uses dominating demand. Global silver mine production in recent years hovers around 820-850 million ounces annually, while total demand exceeds 1.16 billion ounces (2024 figures from the Silver Institute), driven largely by solar panels, electronics, and EVs.

Samsung’s battery requires silver in the Ag-C anode to stabilize lithium metal and prevent dendrites.

Estimates suggest:

- ~5 grams of silver per battery cell.

- Up to 1 kilogram (1,000 grams) per typical 100 kWh EV battery pack.

No, that number is not a typo!

32.15 troy oz of silver will be required for EACH AND EVERY Samsung EV Silver Solid State Battery Pack!!

This is significant because current lithium-ion EV batteries use minimal silver (mostly in electronics, ~25-50 grams per vehicle).

Switching to silver-based ASSBs could dramatically increase demand.

Potential Demand Scenarios

Global EV production is projected to reach 20-30 million units annually by the late 2020s. Adoption rates for solid-state batteries will depend on cost, scalability, and competition (e.g., from Toyota or QuantumScape).

- Conservative (20% adoption of ~16 million EVs/year) → Additional ~16,000 metric tons (514 million ounces) of silver demand annually — roughly 60-65% of current global mine production.

- Moderate (50% adoption) → ~40,000 metric tons — exceeding total annual supply.

- Aggressive (80%+ adoption) → Could consume nearly all global silver output, forcing rationing or substitutions.

Silver recycling from batteries is limited in the short term due to long lifespans (20 years), and new mining supply grows slowly (often as a byproduct of copper/lead/zinc).

Existing industrial demand (e.g., solar alone ~200+ million ounces/year) already strains supply, contributing to multi-year deficits.

How High Could Silver Spot Prices Go?

As of mid-December 2025, the silver spot price has traded as high as $69.51 per ounce, up sharply from ~$30-$32 earlier in the year amid industrial strength and deficits, and up an astonishing 141% YTD.

This reflects growing anticipation of technologies like Samsung’s ASSB.

If widespread adoption begins in 2027:

- Short-term supply shocks could push prices to $100-150/oz as fabricators and investors hoard physical silver.

- In extreme scenarios (high adoption + persistent deficits), prices could reach $200+/oz or higher, reminiscent of past squeezes but backed by genuine industrial pull.

- Long-term equilibrium might settle lower if alternatives emerge (e.g., silver-free anodes) or mining ramps up, but structural demand growth favors sustained highs.

However, risks remain: Samsung could pursue parallel paths (e.g., non-silver electrolytes), costs may delay rollout, and competitors could attempt to avoid silver.

Still, even partial success could tighten the global silver market significantly- in a market that is already stretched nearly to the breaking point with physical supply shortages. Silver lease rates hit 40% in October 2025 due to a sudden shortage of physical silver. A MASSIVE increase in industrial demand for the metal only threatens to exacerbate potential supply issues in the global silver market.

Samsung’s silver solid-state battery represents a revolutionary step for EVs—safer, longer-range, faster-charging vehicles.

But it also introduces a potential “silver bomb” for the physical market, where explosive new demand could propel spot prices to previously unfathomable all-time highs.

Investors and industry watchers should monitor commercialization timelines closely, as this technology could redefine both mobility and precious metals markets.