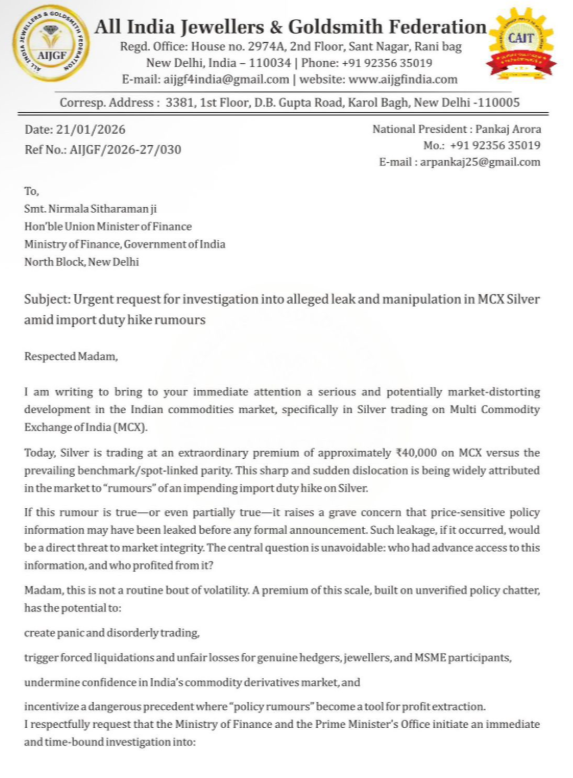

The next leg up in silver has already begun in India, as a major price breakout occurred today as rumors of imminent import tariffs induced a panic buying frenzy that sent silver prices as high as $113.88/oz (₹335,521/kilo).

Indian Jewelers are crying afoul, claiming the silver squeeze was triggered by a leak that the Indian government is preparing to begin import tariffs on silver:

Regardless the reason, with new Position Limits implemented in Shanghai, INDIA has taken the lead in POWERING SILVER HIGHER.

Silver In China (SHFE) Closed at $102.78 (¥23,038).

Silver In US (COMEX) Is Trading ~ $93.

SILVER IS TRADING ON INDIA’s MCX EXCHANGE AT AN $20 PREMIUM TO US PAPER!!

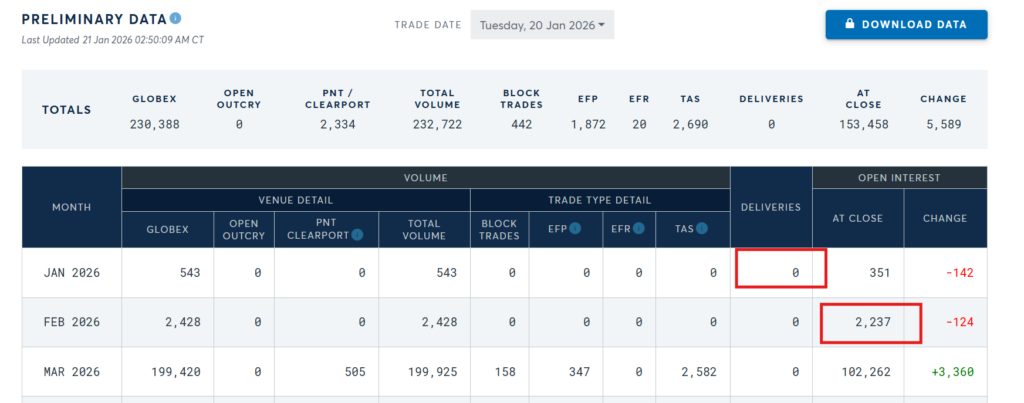

In the US silver market, for the past couple of weeks we have identified & followed BACKWARDS ROLLING in COMEX Futures- Open Interest in the March Front Month Declining, With a Nearly Identical Increase in the Jan & Feb Contracts.

This rush to roll March contracts backwards to take immediate delivery in a NON primary delivery month finally paused Tuesday, with 0 deliveries reported, and small declines in the Jan (-142) and Feb (-124) contracts, while March OI increased 3,360 to 102,262.

February OI remains at 2,237 however.

Currently potential February delivery demands stand just north of 11 million oz. These numbers can certainly change/increase, as March contracts can continue to roll backwards for immediate delivery come Feb, as we saw occur throughout January to the tune of over 40 million oz!

The bullion banks have received a small breather from the relentless bleed of physical they have sustained over the past 4 months as the silver price consolidates in China between $102-$105/oz, but today’s silver breakout in India threatens to trigger another major squeeze in both Shanghai and NY.