BACKWARD ROLLING??

Something extremely significant is occurring in COMEX silver, which we just picked up from the CME’s 1/7 Open Interest Data.

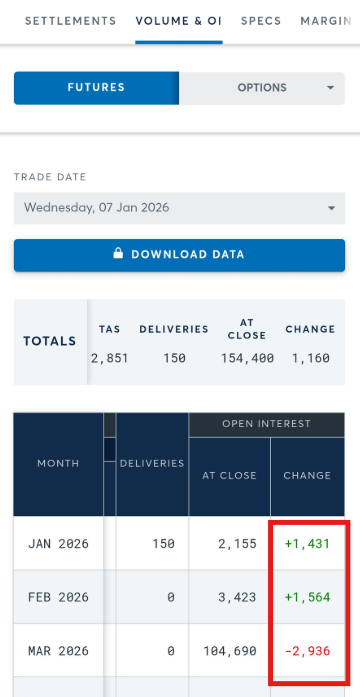

Open Interest in the Jan 2026 contract rose 1,431 contracts on the day yesterday.

Open Interest in the Feb 2026 contract also rose 1,564 contracts.

➡️Jan + Feb OI increased by 2,995 contracts.

🔥Meanwhile, the Silver “Front Month” March 2026 OI declined by a nearly identical 2,936 contracts.

Evidence of Backward Rolling Suggests MASSIVE Near-Term Tightness in PHYSICAL SILVER!

The near-matching numbers (+2,995 in Jan/Feb vs. -2,936 in March) strongly indicate position rolling from March BACKWARDS to January/February.

In futures trading, rolling involves closing a position in one expiration and opening a similar one in another month to maintain exposure without taking delivery.

Typically, rolls are forward (to the next front month) in normal markets, as traders wish to maintain a position in silver (exposure to the silver price), without taking physical delivery of the metal.

Backward rolling (moving the position from the front month March to nearer months, as seen here) indicates the exact opposite: backwardation along with IMMEDIATE SCARCITY OF PHYSICAL SILVER METAL AS TRADERS WISH TO TAKE DELIVERY INSTEAD OF MERELY REMAINING EXPOSED TO THE FUTURES PRICE OF SILVER.

Why would traders pay a backwardation premium, PLUS in and out costs to roll 2,995 silver contracts backward to nearer months?

IT INDICATES THAT PHYSICAL SILVER IS CURRENTLY SO SCARCE THAT TRADERS CAN NOT WAIT UNTIL MARCH TO TAKE DELIVERY, DELIVERY OF 15 MILLION OZ OF SILVER IS NEEDED NOW!

One of two things are likely occurring:

Longs positioning aggressively to stand for immediately delivery, which will further drain COMEX registered stocks and further exacerbate the silver shortage.

Conversely, if shorts are involved in the roll, they might be attempting to avoid delivery demands in March by shifting earlier, but this would still be extremely dangerous for shorts amid tight supply and increasingly more contracts standing for delivery in January.

Longs positioning aggressively to stand for immediately delivery, which will further drain COMEX registered stocks and further exacerbate the silver shortage.

Conversely, if shorts are involved in the roll, they might be attempting to avoid delivery demands in March by shifting earlier, but this would still be extremely dangerous for shorts amid tight supply and increasingly more contracts standing for delivery in January.

The simplest explanation is the most plausible.

The silver shortage has reached such an extent that longs can no longer wait until the front month contract (March) to stand for delivery.

The silver shortage has reached such an extent that longs can no longer wait until the front month contract (March) to stand for delivery.

Silver is needed NOW.

If we are correct, the COMEX is in BIG trouble.