Asian demand and the Shanghai Silver Premium Surging to $13/oz has literally hamstrung the cartel’s ability to continue controlling the global physical silver market using paper leverage.

It appears that a NEW DAY has dawned for silver…

CME Open Interest Data Continues to Show Backwards Rolling for Immediate Jan Silver Deliveries!

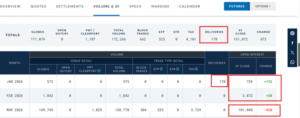

🔥206 Deliveries Were Reported in the Jan Silver Contract Wednesday, Yet January Silver Open Interest Only Declined by 72 Contracts, Suggesting Another 134 Contracts Rolled Backwards from March to Jan for Silver Delivery.

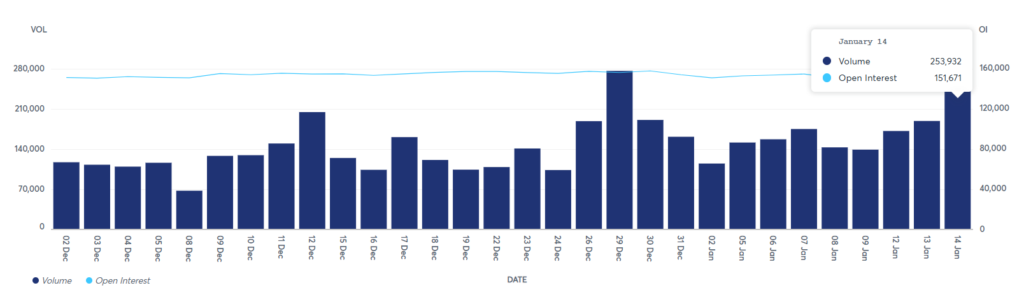

For the first time this week, Open Interest in the Front Month March INCREASED 689 contracts on the day to 101,291 – likely all on the short side as prices were smashed nearly $8 from $93.70 to $86 Wednesday afternoon.

🚨The fact that OI only increased 689 contracts when volume increased 64,156 contracts (320 MILLION OZ) from Tuesday’s 189,776 to 253,932 indicates that the cartel covered 99% of their new shorts added Wednesday immediately after inducing the silver price smash!

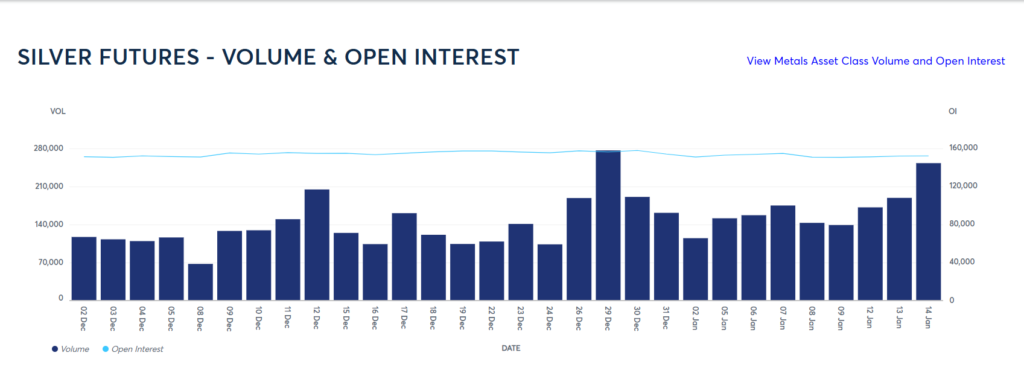

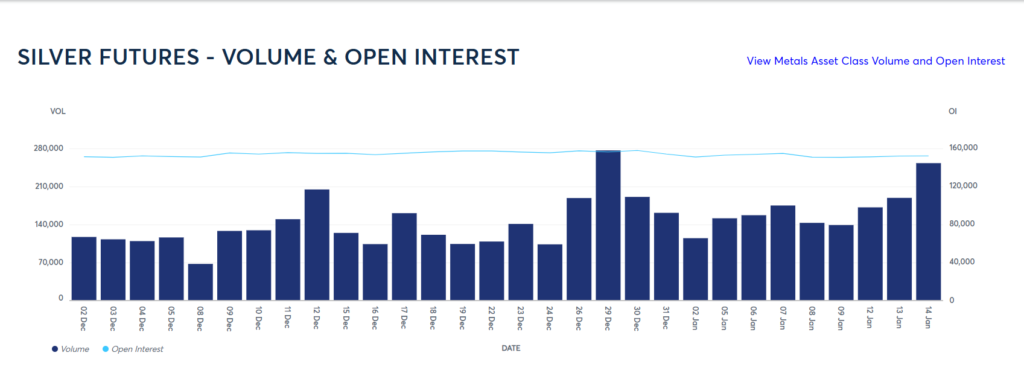

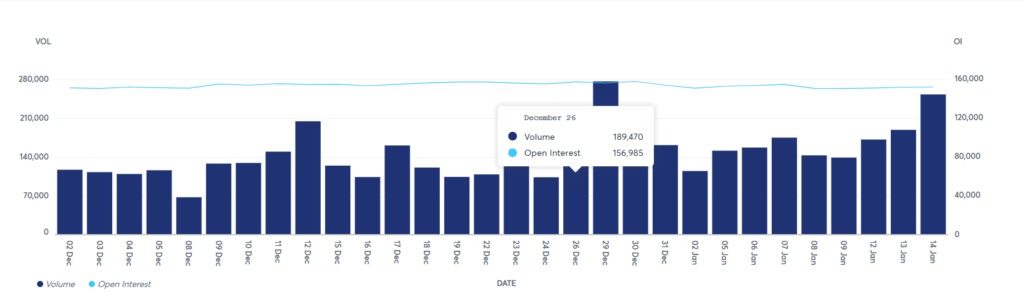

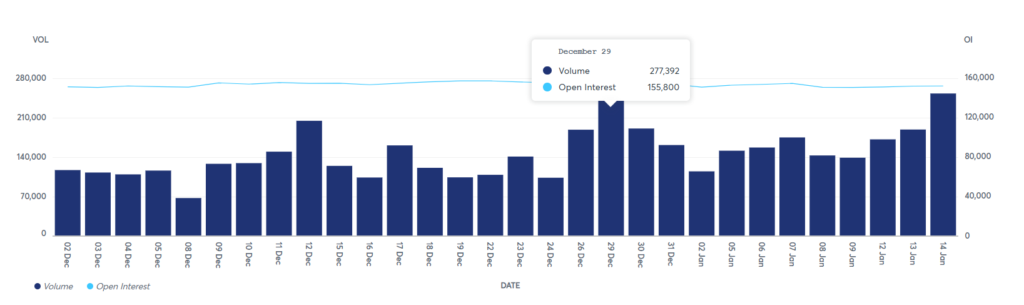

We last saw THE EXACT SAME pattern in the OI data on December 29th, as silver prices were slammed overnight from a record high $83.98 back to $76:

Open Interest that preceding Friday 12/26 was 156,985 contracts, with total volume of 189,470.

On December 29th, volume EXPLODED to 277,392 contracts – a massive increase of 87,922 contracts, or 440 MILLION OZ – more than half an entire year’s global silver supply.

Yet the closing Open Interest on 12/29 after the cartel dumped half a BILLION oz on the market to DETONATE silver prices was only 155,800 contracts- a DECREASE of 1,185 contracts.

The implications are that the cartel bullion banks IMMEDIATELY covered the entire half a billion oz naked short position that triggered silver’s massive price sell-off.

The CME’s Open Interest data for Wednesday indicates THE EXACT SAME PATTERN occurred yesterday, as the cartel covered 99% of the 320 MILLION OZ of paper silver dumped on the market to trigger silver’s sell-off as it threatened to take out $94 Wednesday afternoon.

This would also perfectly explain why silver has shown such strength in recovering all the way back to $92.70 early this afternoon.

The demand for silver is so insatiable that as soon as the cartel bullion banks cover the shorts they dump on the silver market, the silver price is immediately surging back higher like a beach ball held at the bottom of the ocean.

This is a phenomenon that we suspect has caught the cartel completely off-guard, and represents a significant change to the bullion banks SOP on silver slams.

Asian demand and the Shanghai Silver Premium Surging to $13/oz has literally hamstrung the cartel’s ability to continue controlling the global physical silver market using paper leverage.

It appears that a NEW DAY has dawned for silver…