The Global Structural Silver Defecit can only be alleviated through higher silver prices, increased production, or decreased demand (by cutting off Chinese access to Western metals).

The Trump Administration just FIRED ALL 3 SILVER WEAPONS at China SIMULTANEOUSLY.

SILVER PRICE FLOORS & NATIONAL SECURITY

An Analysis of the US Critical Minerals Ministerial Meeting Focusing on the Impending Global SILVER SHORTAGE

When JD Vance or Marco Rubio use the words “critical minerals”, understand that this is code for “PHYSICAL SILVER”.

The “PHYSICAL SILVER” Ministerial, held on February 4, 2026, in Washington, D.C., brought together representatives from over 20 countries, including major producers like Australia, Canada, and Peru, as well as consumers and partners such as India, Japan, Morocco, Pakistan, Qatar, and Saudi Arabia.

The event focused on reshaping global supply chains for critical minerals (PHYSICAL SILVER) to enhance economic and national security, reduce vulnerabilities, and promote diversification away from concentrated sources.

The opening remarks emphasized international cooperation, policy reforms, and addressing market distortions like erratic pricing and non-market practices.

While the remarks used only CODE WORDS for silver, the themes align EXACTLY with our assumption that the meeting was primarily about sourcing physical silver amid a major supply deficit, especially given silver’s recent designation as a U.S. critical mineral and its ongoing structural shortages.

Key Speakers and Their Remarks

The opening session featured high-level U.S. and international officials outlining strategies for PHYSICAL SILVER security.

Here’s a breakdown:

Secretary of State Marco Rubio Opened by framing economic security as national security, highlighting U.S. efforts to diversify supply chains through executive orders on permitting reform, $10 billion in international agreements, and initiatives like the PAX Silica Summit. He referenced historical U.S. leadership in minerals & called for bilateral framework agreements to protect production and coordinate policies among allies.

Translation: The West CANNOT allow China to corner the silver market!

Vice President JD Vance: Compared PHYSICAL SILVER to oil in importance for technologies like data centers and defense. (both references use MASSIVE amounts of silver)

He criticized brittle, concentrated supply chains and foreign oversupply leading to price collapses that stall projects. (US critical shortage of silver refineries, & Chinese silver funds which triggered the 40% crash in silver prices)

Vance proposed a preferential trade zone with enforceable price floors via tariffs to stabilize markets, encourage investment, and achieve self-reliance through alliances representing two-thirds of global GDP.

He noted U.S. actions like $100 billion in lending, mining stakes, new smelters, and Project Vault for stockpiling.

Japanese State Minister Horii Iwao: Echoed concerns over disruptions, advocating for source diversification in mining, refining, and processing.

He cited Japan’s 2022 Economic Security Promotion Act, $3.5 billion budget, and partnerships with countries like Angola and Australia. Iwao praised U.S. leadership and warned against market distortions, emphasizing forums like FORGE for policy coordination.

The remarks collectively addressed supply chain vulnerabilities, geopolitical risks, long development timelines, and the need for allied self-reliance—issues that resonate with silver’s market dynamics.

Analysis Based on Our Assumption of Focus on Silver Sourcing

Assuming the meeting was primarily about sourcing physical silver amid a major supply deficit, the remarks can be interpreted as a strategic response to China’s attempts to attack the US financial system’s Achille’s Heel- the PHYSICAL SILVER MARKET.

Silver was officially added to the U.S. Geological Survey’s Critical Minerals List in November 2025, recognizing its vital role in green energy (e.g., solar panels), electronics, EVs, AI infrastructure, and defense, alongside risks from concentrated supply chains (primarily from Mexico, Peru, and China).

This addition elevates silver from a precious metal to a “strategic asset,” aligning with the meeting’s emphasis on treating minerals as essential infrastructure.

The global silver market has been in a structural deficit for five consecutive years (2021–2025), with a cumulative shortfall of nearly 820 million ounces—equivalent to about a year’s mine production.

In 2025, the deficit reached approximately 95 million ounces (about 10% of global supply), driven by industrial demand outpacing mine output and recycling.

Projections for 2026 indicate the deficit could widen to 200 million ounces, exacerbated by China’s export restrictions on silver as a strategic material, fragmenting global supply.

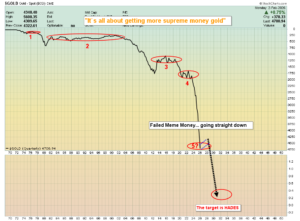

This “Triple Threat” of demand from solar, EVs, and AI has pushed prices to historic highs over $120 per ounce in early 2026, up from $28 in 2024, before crashing back to $71 as of this writing.

Under this lens:

Diversification and Supply Chain Security:

Vance’s critique of concentrated chains and price collapses mirrors silver’s vulnerabilities—e.g., reliance on Latin American mines and Chinese processing, with deficits leading to project stalls. The proposed trade zones and tariffs could stabilize silver pricing, rewarding U.S. and allied production (e.g., in Alaska’s Ambler district, which includes silver).

International Cooperation:

Partnerships highlighted (e.g., with Peru, and Mexico- both top silver producers.

Japan’s diversification efforts and warnings against distortions address silver’s market manipulations, potentially leading to coordinated sourcing from allies.

Addressing Deficits and Challenges:

Copley’s focus on stockpiling (e.g., Project Vault) and permitting reforms directly tackles silver’s long timelines and supply gaps. U.S. investments in mining stakes could boost domestic output, reducing deficits.

Broader Implications for Silver

This meeting signals a policy-driven push to treat silver as a national security priority, potentially through tariffs, subsidies, or alliances to counter deficits.

In summary, even without explicit references, the remarks provide a blueprint for addressing silver’s supply crisis through allied diversification and market protections, potentially alleviating the 2026 deficit and stabilizing sourcing for industrial needs.

China began WORLD WAR SILVER, but Trump just LAUNCHED THE US COUNTER-ATTACK.

The Global Structural Silver Deficit can only be alleviated through higher silver prices, increased production, or decreased demand (by cutting off Chinese access to Western metals).

The Trump Administration just FIRED ALL 3 SILVER WEAPONS at China SIMULTANEOUSLY.